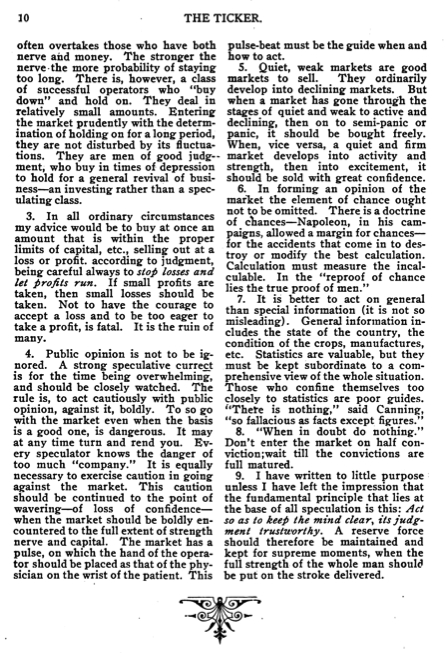

1. The stock market is never obvious. It is designed to fool most of the people, most of the time.

2. Play the market only when all factors are in your favor. No person can play the market all the time and win. There are times when you should be completely out of the market, for emotional as well as economic reasons.

3. Do not use the words “Bullish” or “Bearish.” These words fix a firm market direction in the mind for an extended period of time. Instead, use “Upward Trend” and “Downward Trend” when asked the direction you think the market is headed. Simply say: “The line of least resistance is either upward or downward at this time.” Remember, don’t fight the tape!

4. The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.

5. The only thing to do when a person is wrong is to be right, by ceasing to be wrong. Cut your losses quickly, without hesitation. Don’t waste time. When a stock moves below a mental stop, sell it immediately.

6. Emotional control is the most essential factor in playing the market. Never lose control of your emotions when the market moves against you. Don’t get too confident over your wins or too despondent over your losses.

7. All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.

8. Watch the market leaders, the stocks that have led the charge upward in a bull market. That is where the action is and where the money is to be made. As the leaders go, so goes the entire market. If you cannot make money in the leaders, you are not going to make money in the stock market. Watching the leaders keeps your universe of stocks limited, focused, and more easily controlled.

9. Failure to take advantage of a serendipitous act of good luck in the stock market is often a mistake.

10. There is nothing new on Wall Street or in stock speculation. What has happened in the past will happen again, and again, and again. This is because human nature does not change, and it is human emotion, solidly build into human nature, that always gets in the way of human intelligence. Of this I am sure.

Note: Read more.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.