Since 1996 thousands of investors and traders have trusted my research and systems for a complete trend following trading education. Investors and traders from 70+ countries have learned that trading systems and educational materials I provide, along with the interpretation of those materials and my personal coaching, are worth far more than advertised prices.

That said, in a world where some believe “free” (e.g. stock picking sites, chat rooms, free everything, infomercials, get rich quick schemes, etc.) is the path to an easy fortune, there are sometimes reservations about spending on education.

To that I say: Start with the basics.

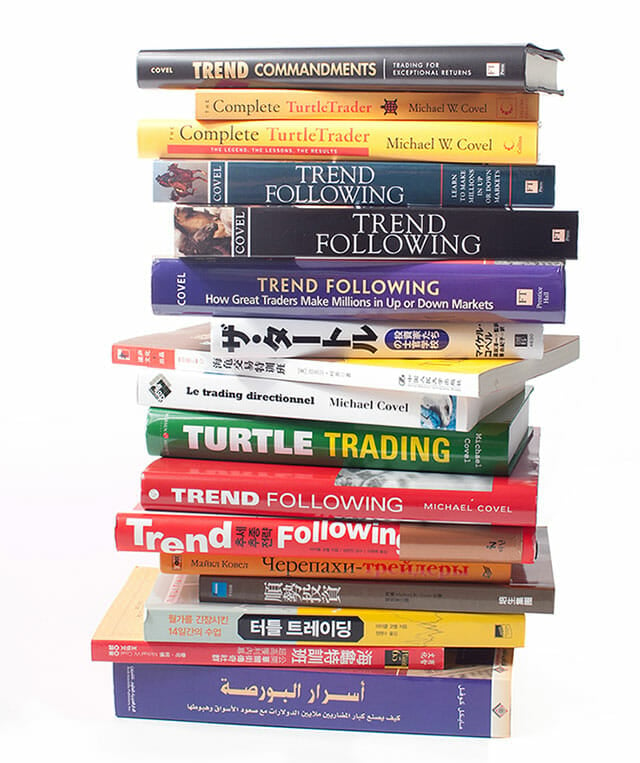

All investors and traders should dig in. All of that money-making insight has been acquired through an intense 15-year period of research, and carefully sewn together for easy understanding. Even if you never come to me for additional training, the podcast, the books, film and blog are one of a kind resources found nowhere else.

Bottom line, a proper analysis of my trend following trading education comes down to fixed costs, sunk costs and opportunity costs. First, consider the definition of a “fixed cost”:

“In economics, fixed costs are business expenses that are not dependent on the activities of the business. They tend to be time-related, such as salaries or rents being paid per month.”

The definition of a “sunk cost”:

“Sunk costs are retrospective (past) costs which have already been incurred and cannot be recovered. Traditional economics proposes that an economic actor does not let sunk costs influence one’s decisions, because doing so would not be rationally assessing a decision exclusively on its own merits.”

The definition of an “opportunity cost”:

“Opportunity cost or economic opportunity loss is the value of the next best alternative forgone as the result of making a decision. The next best thing that a person can engage in is referred to as the opportunity cost of doing the best thing and ignoring the next best thing to be done.”

What do these three definitions mean in the context of my training?

My training is a fixed cost. It is not variable. You can plan around it. In terms of sunk costs, whether a bad investment, a bad book, a bad course or whatever, hanging on to money already spent is bad business.

And at the end of the day the opportunity cost of not learning how to properly trend follow might be the biggest potential mistake any investor can make. The evidence shows that trend following is the superior option for making money. If you are doing something else, by definition your opportunity cost is missing out on trend following performance.

My view on Zero sum trading.