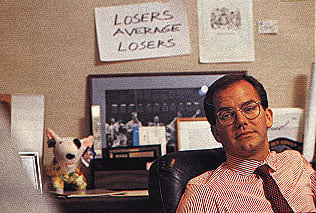

There is a famous picture of trader Paul Tudor Jones relaxing in his office with his feet kicked up. A single sheet of loose-leaf paper is tacked on the wall behind him with the simple phrase written out in black marker: “Losers Average Losers”.

Trite meaningless talk? Not so fast.

Famed trader Jesse Livermore warned 100 years ago against averaging losses. For example, you buy a stock at 50, and two or three days later if you can buy it at 47, you average down by buying another hundred shares, making an average price of 48.5. Having bought at 50 and being concerned over a three-point loss on a hundred shares, what rhyme or reason is there in adding another hundred shares and having the double worry when the price hits 44? At that point, there would be a $600 loss on the first hundred shares and a $300 loss on the second shares. If you are able to apply such an unsound principle, you can keep on averaging down by buying 200 at 44, then 400 at 41, 800 at 38, 1600 at 35, 3200 at 32, 6400 at 29, and so on.

Losses are a part of the game.

You want no losses? You want positive returns every month? It does not work that way, that is, not unless you were lucky enough to be invested in the Bernard Madoff Ponzi-scheme which has resulted in assorted criminal convictions and a few suicides. Losses are not your problem. Its how you react to them. Ignore losses with no plan, or try to double down on your losses to recoup, and those losses will come back like a Mack truck to run over your account.

Some say:

“Don’t frown, double down! Not smart strategy.”

Wrong.

It’s escalator up, express elevator down.

You can’t win if you are not willing to lose. It’s like breathing in, but not breathing out.