Feedback in:

Hey Mike!

Just a quick one to say thanks for your podcast and your work. Just finished your book and have been listening to your podcast for about 6 months now. I’ve been studying in a share trading diploma here in Australia to get me started but as I’ve progressed I’ve noticed so many holes in the theories surrounding market timing in particular. I haven’t been content to just assume these methods work.

I’m a huge Oakland A’s fan and I’m a big sabermetrics guy. Trend Following looked like the most logical method of trading to me, but once you compared it to baseball it concreted it in my mind. It’s logical! You can’t argue a point (very well) with qualitative data. In my mind that applies to everything in life…. so why not trading?

Appreciate your insights.

[Name]

Thanks.

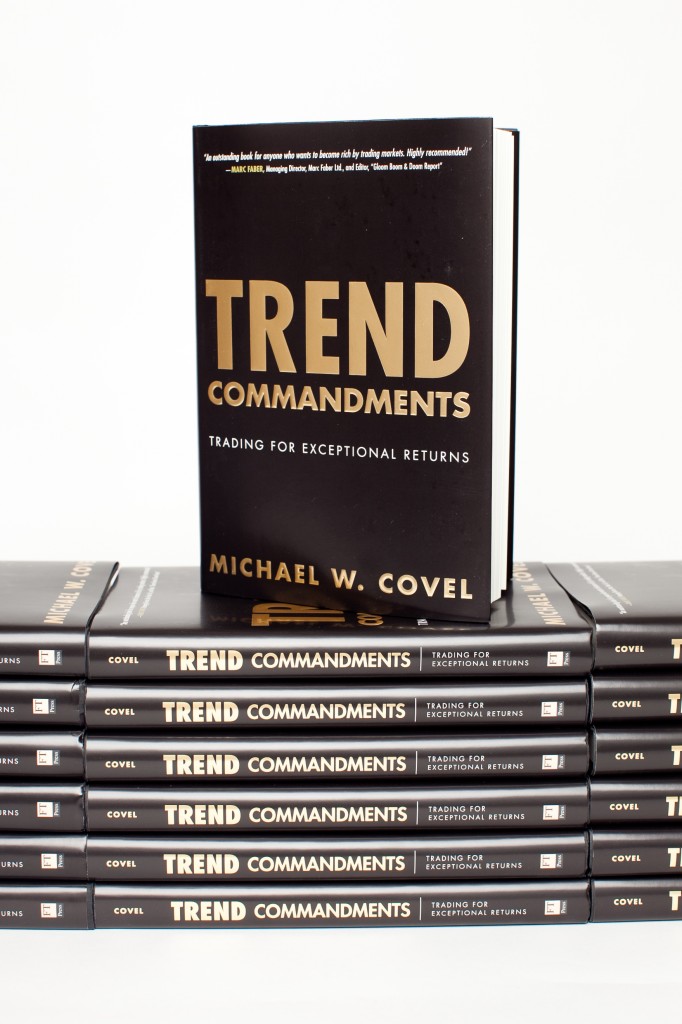

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.