Trend following performance rock and roll for June (source):

Sector titans ride Brexit to record largest monthly gain since November 2014, SocGen benchmark shows

London-based trend manager Mulvaney Capital Management surged 27.4% as one of the standout CTA performers in the wake of the Brexit vote.

The $224m London-based manager, founded in 1999 by CEO and CIO Paul Mulvaney, a former Merrill Lynch options trader with computer science background, takes a long-term approach to capturing trends, holding positions for six months on average.

Its Global Markets Program was reportedly up 17% on Friday 24 June as global stock markets tumbled and the pound fell to a 31-year low after the Brexit vote, marking its best day ever.

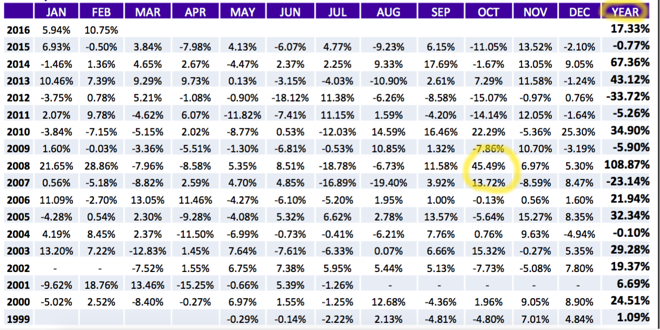

The program, which has an annualised volatility of 31% was also the standout performer in Europe in 2014, gaining 67% as CTAs had a stellar year amid tumbling oil price and sinking bond yields.

Mulvaney’s return last month recovered earlier losses this year to advance to 15.1% YTD.

Switzerland-based Amplitude Capital saw strong gains, with the firm’s $929m Klassik fund returning 9.98% for June.

Amplitude’s $540m Dynamic fund also saw monthly gains, returning 7.19% with 3 out of 4 asset classes contributing to this result.

Among smaller managers, New Jersey-based NuWave Investment Management also had a strong month, with its main $36m futures portfolio gaining 13.3% in June having been broadly flat YTD at the end of May.

The largest CTAs recorded their biggest monthly gain since November 2014, according to Societe Generale’s benchmark.

The SG CTA Index, which tracks a group of the largest 20 CTAs, ended the month up 4.4% to return to positive territory for the year, up 4.1% YTD.

Among the best performing constituents of the index, Transtrend’s $4.8bn enhanced risk version of its Diversified Trend Program surged 7.5% to hit 8.4% YTD.

Lying flat YTD coming into June, Brummer-backed Lynx Asset Management was up an estimated 10.3%, likely to go down as the $6.3bn Swedish manager’s best month since August 2010.

London and US-based ISAM saw its $1.4bn Systematic Trend program gained an estimated 4%, to pare back YTD losses to -3.2%.

Trend-followers jumped 5.3% in June, according to the SG Trend Index.

It was their best month since August 2014, and they hauled themselves back into the back this year, up 1.9%YTD.

Short-term traders advanced 1.6% in June to remain the best performers this year, up 5.8%.

For Sydney-based Boronia Capital, June was best return since a 10.2 gain in May 2012. The $842m manager was up 5.7% last month to climb to 9.7% YTD.

Quest Partners’ $325m AlphaQuest Original Program was up 6.6% in June and advanced to 18.3% this year. It scored its bets returns through vol breakout systems.

The SG CTA Index had surged 2.3% on 24 June, the day after the UK’s EU referendum. It was its best one-day gain since a 2.7% jump on 20 December 2000, when the Nasdaq plunged after a flurry of analyst downgrades and corporate results drove US technology stocks sharply lower.

Eighteen of the managers in the index made positive returns on 24 June. A similar number reported positive returns for the full month.

Performance figures announced last week showed that CTAs weathered Britain’s EU referendum result well, despite mid-month market uncertainty, having benefitted from diversification across asset classes and positioning.

“CTAs have, so far, managed to weather the Brexit storm by benefitting from diversification across asset classes and positioning,” said James Skeggs, global head of alternative investments consulting at Societe Generale Prime Services.

“The strong returns seen in June were the result of trends in bond, commodity, and currency markets.

Attribution data from the SG Trend Indicator suggests gains in the bond (+4.6%), commodities (+1.1%), and currency (excluding GBP/USD +1%) sectors.

Skaggs added: “In the current environment there is understandably a great deal of investor interest in these strategies which have posted positive returns in eight of the last nine quarters.”

Next Brexit? Are you ready?

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.