From Alex Brown at Morningstar:

You should be skeptical of anyone who claims to be able to predict the future from the past. If it were so easy to beat the market using past returns, everyone would exploit that relationship until it is arbitraged away. The momentum effect violates that principle. Momentum is based on the premise that securities that have recently outperformed will continue to do so in the short run, and those that have underperformed will continue to lag. While practitioners have been exploiting this relationship for decades, the idea has gained broad acceptance in the academic community only within the past 20 years. Momentum runs counter to the predictions of the efficient market hypothesis, but the evidence is too overwhelming to ignore.

Jegadeesh and Titman published one of the first influential studies on momentum in 1993, “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” They found that U.S. stocks with the best performance over the past three-12 months continued to outperform the worst-performing stocks over the next year, using data from 1965 to 1989. Subsequent research found that the momentum effect was also present in the U.S. before and after this original sample, which suggests that the effect was not simply the product of data mining. Generally any momentum signal between six and 12 months worked, though there tends to be a short-term reversal at one month. It has become convention among many researchers to study the momentum effect using stock returns over a trailing 12-month period, excluding the most recent month. However, the results are robust and do not depend on this particular definition.

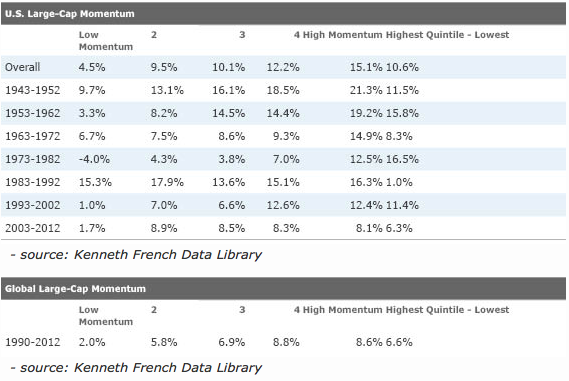

Momentum is pervasive. Many studies have extended this evidence to foreign stocks, commodities, currencies, and bonds. Momentum even works across individual asset classes and country stock indexes. Even efficient market advocates Eugene Fama and Kenneth French found the momentum effect in every stock market they studied, except Japan (see “Size, Value, and Momentum in International Stock Returns”). The tables below illustrate the momentum effect among large-cap U.S. and global stocks. Each column represents a fifth of the total number of stocks in the sample, which are ranked by their momentum. While there is not a linear relationship between the momentum quintiles, stocks with the highest momentum consistently outperform those in the lowest momentum quintile. Small-cap stocks tend to exhibit a stronger momentum effect. However, they can be more expensive to trade.

This evidence creates a puzzle. If the market were efficient, a simple trading rule should not produce superior returns. Arbitrage is a powerful force that should eliminate any excess profits, and yet, momentum has persisted 20 years after it was first widely published. Perhaps more troubling to disciples of Ben Graham and Warren Buffett, momentum appears to be at odds with decades of research, which suggest that stocks trading at low valuations tend to outperform.

Explanations

Behavioral finance offers the best explanation for the momentum effect. Those in this camp assert that investors tend to anchor their beliefs and are slow to update their views in response to new information. For instance, event studies have demonstrated that stocks that beat earnings expectations tend to offer excess returns for many weeks after the announcement. Similarly, stocks that miss expectations tend to continue to underperform. Behavioral finance research also suggests that many investors engage in irrational mental accounting, which may further contribute to this market underreaction. According to this view, investors are reluctant to sell losers in the hope of breaking even and quick to sell winners in order to lock in gains. This irrational behavior may prevent stocks from quickly adjusting to new information. Once a trend is established, investors may pile onto a trade and over extrapolate recent results, pushing prices away from their fair values, which may explain the long-term reversals underlying the value effect (the tendency for stocks trading at low valuations to outperform).Momentum is consistent with the value premium and may even contribute to it. While momentum tends to persist in the short term (performance over the past six-12 months continues over the next few months), stocks that have been beaten down over the past three to five years tend to do better than their counterparts that outperformed over that horizon. Where this value effect allows investors to profit from the market’s pessimism, momentum allows investors to profit from its optimism. In their paper, “Value and Momentum Everywhere,” Asness, Moskowitz, and Pedersen found that momentum worked well when value didn’t, and vice versa. Because they are two sides of the same coin, each with excess returns, combining value and momentum in a portfolio can offer powerful diversification benefits.

Risks

Although momentum looks good on paper, these strategies require high turnover, often in excess of 100%, in order to work. That can create high transaction costs that may erode profits. Additionally, momentum does not work well when volatility spikes. Consequently, the strategy can underperform when it is most painful. For instance, momentum significantly underperformed during the 2008 global financial crisis. Unlike value strategies where lower valuations predict better long-run returns, it is difficult to gauge when momentum is likely to outperform. This risk may limit arbitrage and allow momentum to persist. In fact, there are only a handful of pure momentum funds available to most investors.Recommendations

While a diversified and systematic momentum strategy can offer a powerful way to enhance returns, selecting a few stocks on the 52-week high list is a very bad idea. It is difficult to anticipate when a run will end and there may be no greater fool to bail you out. Although momentum is a short-term phenomenon, it is best suited for long-term investors. It won’t always work, but there’s a good chance that a disciplined momentum strategy will continue to outperform over the long term. After all, investor behavior won’t change overnight.AQR Momentum (AMOMX), AQR Small Cap Momentum (ASMOX), and AQR International Momentum (AIMOX) offer investors an effective way to harness momentum. Each of these funds invests in stocks representing the third of their respective market segments with the highest momentum. AQR balances transaction costs against momentum when deciding whether to trade, which helps rein in expenses. However, because these funds have high turnover, they are most suitable for tax sheltered (retirement) accounts. While the $5 million minimum investment may seem a little steep, there is no minimum for investors who gain access to these funds through a financial advisor.

PowerShares DWA Technical Leaders (PDP) may be a suitable alternative for investors who do not have a financial advisor. This fund targets 100 stocks with the best performance from a broad universe of U.S. large- and mid-cap stocks, and weights them according to their relative strength (a form of momentum). In order to reduce turnover, PDP rebalances only quarterly, which can hurt its performance when the market is choppy.

Combining Value and Momentum

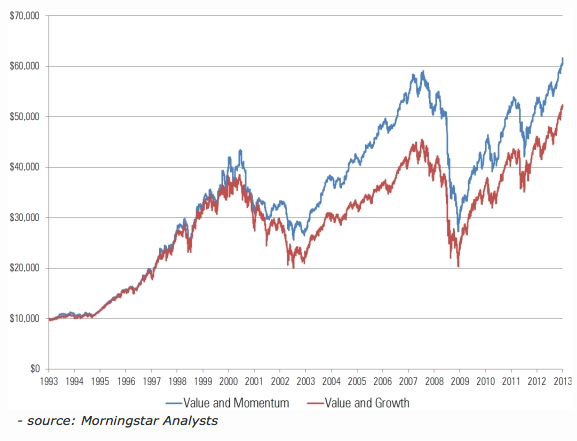

It’s not necessary, or advisable, to abandon value investing to benefit from momentum. Instead, momentum may be a good substitute for investors’ growth allocations. Momentum offers higher expected returns than growth and tends to be less correlated with value. The chart below compares the performance of a portfolio consisting equal weights in the Russell 1000 Value and Growth indexes, with a portfolio that replaces the growth allocation with the AQR Momentum Index. The two portfolios have similar volatility, but the value and momentum portfolio offers slightly better absolute and risk-adjusted returns.

Read original article here.

Recommended Trend Following Podcast Episodes and Articles: Babe Ruth Effect, History of Trend Following Stocks, Making Money Every Month Trading, Momentum Chasing, and Barbara Fredrickson Interview.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.