From Attain Capital Management:

In many ways, it can all come down to one decision- one choice in one moment that crystallizes a path in front of you. That path is rarely straight and often difficult to navigate, but once that moment has come and gone, the rest- as they say- is history. For Liz Cheval, chairwoman of the close to $150 million managed futures program EMC, that decision was the choice to respond to Richard Dennis’ famed turtle trader ad.

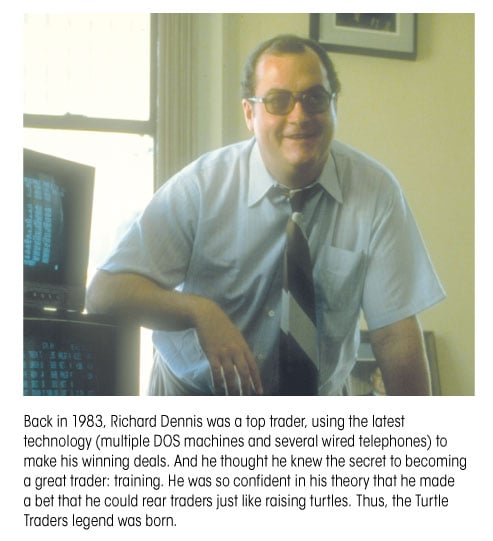

The story of the turtle traders [see my book The Complete TurtleTrader for more] is pretty fantastic in and of itself. Two renowned traders disagree. One says that what they do is unique, while another says that he could train anyone to trade. They make a wager on the issue, an ad is placed in the paper, and the lives of 20 students would never be the same. As the only female selected for the program, Cheval’s life was turned upside down.

After receiving a degree in mathematics from Lawrence University in Appleton, Wisconsin, Ms. Cheval was working as a trade clerk at the Chicago Board of Trade when Mr. Dennis placed his ad in the paper. At the time, women were few and far between in the famed Chicago trading pits. To hear her explain it, it was largely a function of physique.

“When I started on the floor of the CBOT in the early 1980’s… It was difficult for women to compete, given the physical demands of pit trading and the advantages of a larger, heavier frame,” she recalls.

It was on the floor that Cheval found herself drawn to Dennis’ offer. The excitement in the pits over the opportunity was palpable, as resumes were quickly refreshed and rushed to the mail. Cheval found herself being pushed to apply as well, even by those competing against her for a slot (including her employer). When called into an interview, she began to think that maybe she was missing something.

“As I approached the interview, I thought the opportunity with C&D was literally too good to be true,” she explains. “I simply couldn’t believe that a world renowned trader would teach us his methods and give us his private capital to trade. I assumed that there would be a catch, another story revealed at the interview.”

It turned out that the interview was simply the opportunity of the lifetime.

“It was not until the end of the interview, as Mr. Dennis’ top executive explained the nature and the details of the program that I began to believe it was the real deal,” Cheval recounts. “At that point, I became overwhelmed. My throat went dry. My legs were shaking. I could barely walk out of the room. If I understood the true nature of the program at the beginning, I would not have been as collected during the interview and would not have been selected. ”

Being selected may have been the easy part. After the interview began a rigorous amount of training, and the competition was fierce.

“The group was extremely competitive. The dynamic was open, above-board and collegial, but no doubt, everybody wanted to win,” Cheval states.

Even as the only woman in the group, Cheval found herself seamlessly blending into the adrenaline fueled atmosphere. The experience, by and large, was a positive one. She was able to earn the respect of her peers, and believes that working in a group of professional, competitive men helped prime her for professional challenges in the future.

When the training was done, it was time to hit the pavement running. The turtles were hungry to spread their wings and test their mettle. Cheval remembers making phone calls upon completion of the program, trying to gauge the level of interest for outside investors. That former employer who had encouraged her to apply? He became EMC’s first client, investing $1 million.

While it certainly has not been a bed of roses, Cheval has done very well for herself. EMC , which she runs with former turtle Brian Proctor, now has $148.75 million in assets under management, and is as well respected in the industry as you can get, in our opinion. She credits the nuanced strategies involved in managed futures with keeping her in the game. Even with this success, Cheval knows that you need to keep pushing to make it in this industry.

“The ability to adapt to change is the key to long term success in trading. It’s relatively easy to develop a profitable trading strategy over a short time frame. It’s far more challenging to develop a reliable method to continually adapt the strategy to future market conditions,” Cheval states.

Adaptation is especially important in an environment like what is seen today. Managed futures seems to be perpetually under attack by mainstream media pundits and financial advisors, with the bulk of comment being directed toward “greedy speculators.” This misconception, paired with investor frustration over a divergent return stream and increasing government intervention in the markets, can complicate the managed futures conversation, but Cheval is up to the task. In her mind, the theory of the game makes the challenge all the more worthwhile.

Her experience in the industry has granted her a great deal of perspective, and she’s more than willing to share it. The secret to becoming a successful CTA? She’s not keeping mum.

“You need both a successful trading strategy and, more importantly, a reliable method to adapt the strategy to future market conditions. A successful trading strategy requires robust systems and sound risk management principles. The trading strategy is only as good as your research process. You have to identify robust estimators and develop a process to continually adapt the systems based on these reliable estimators,” Cheval says. “You have to be disciplined in executing both trading and research strategies, in good periods and bad. A CTA has to be committed to their strategy whether it is in or out of favor.”

And for all you women out there thinking about entering the field?

“Over the years I encouraged women to manage money because I believed it to be a gender neutral occupation. No one can dispute your contribution based on gender in investment management. Your performance is there in black and white in the P&L report,” states Cheval.

“Go for it. Today the physical advantage of men [in the trading pits] is inconsequential because trading is virtually 100% electronic. I give the same advice to both men and women seeking entry level jobs in managed futures. Technical skills are mandatory. Great thinkers and idea creators need technical applications to test and execute trading strategies. Having those skills is a great way to gain entry or to build your own business.”

However, in our conversations with Cheval, it was her comments on the future of the industry that resonated with us most.

“Money centers will shift, performance will change, but overall, global markets are large and expansive,” she quipped. “Markets and managers will adapt.”

We couldn’t agree more.

Unfortunately, Liz Cheval recently passed away, but her success lives on.

Related Podcasts and Articles:

Trend Following Forward by Charles Faulkner

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.