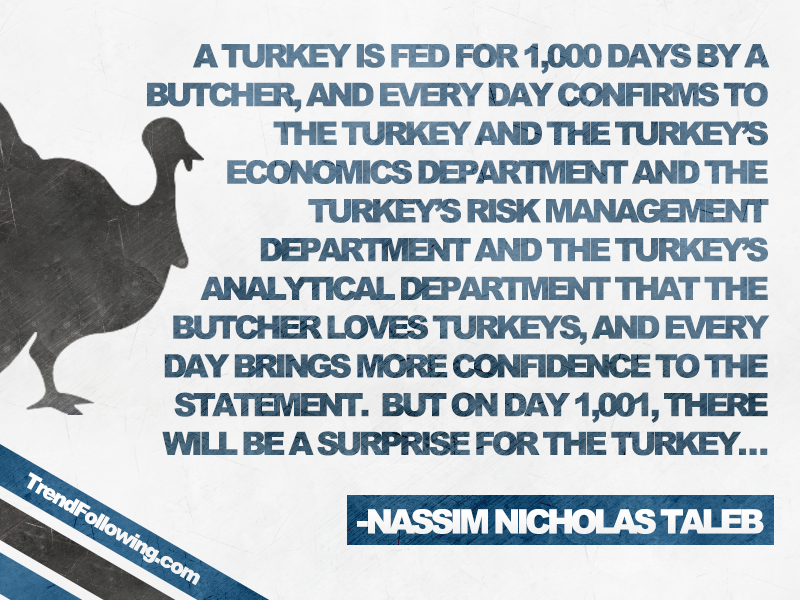

Nassim Taleb and Mark Spitznagel talk about how government intervention postpones the inevitable. Excerpts:

Taleb: Mark, your book is the only place that understands crashes as natural equalizers. In the context of today’s raging debates on inequality, do you believe that the natural mechanism of bringing equality — or, at the least, the weakening of the privileged — is via crashes?

Mark: Well straight away let’s ask ourselves: Are we really seeking realized financial equality? How can we ever know what is the natural or acceptable level of inequality, and why is it even the rule of the majority to determine that? That aside, one can absolutely say logically and empirically that asset-market crashes diminish inequality. They are a natural mechanism for this, and a cathartic response to central banks’ manipulation of interest rates and resulting asset-market inflation, as well as other government bailouts, that so amplify inequality in the first place. So crashes are capitalism’s homeostatic mechanism at work to right a distorted system. We are in this ridiculous situation where utopian government policies meant to lessen inequality are a reaction to the consequences of other government policies — a round trip of market distortion. After we’ve been run over by a car, the assumed best treatment is to back the car over us again.

Taleb: I see you are distinguishing between equality of outcome and equality of process. Actually one can argue that the system should ensure downward mobility, something much more important than upward one. The statist French system has no downward mobility for the elite. In natural settings, the rich are more fragile than the middle class and we need the system to maintain it.

More:

Spitznagel: Well straight away let’s ask ourselves: Are we really seeking realized financial equality? How can we ever know what is the natural or acceptable level of inequality, and why is it even the rule of the majority to determine that? That aside, one can absolutely say logically and empirically that asset-market crashes diminish inequality. They are a natural mechanism for this, and a cathartic response to central banks’ manipulation of interest rates and resulting asset-market inflation, as well as other government bailouts, that so amplify inequality in the first place. So crashes are capitalism’s homeostatic mechanism at work to right a distorted system. We are in this ridiculous situation where utopian government policies meant to lessen inequality are a reaction to the consequences of other government policies — a round trip of market distortion. After we’ve been run over by a car, the assumed best treatment is to back the car over us again.

More:

Spitznagel: The main metaphor of my book is the “Yellowstone effect”: A massive fire in Yellowstone Park in 1988 opened the eyes of foresters to the fact that a century of wildfire-suppression, and with it competition- and turnover-suppression, had only delayed, concentrated, and by far worsened the destruction — not prevented it. This isn’t just about dead-wood accumulation creating a fragile tinderbox network. The real issue is how our tinkering artificially short-circuits the fundamental capacity of the system to allocate its limited resources, correct its errors, and find its own balance through the internal communication of information that no forestry manager could ever possibly possess. (The more this is mocked by technocratic naïfs like Geithner, the more valid it is.) But that capacity is still there, and homeostasis ultimately wins through a raging inferno. This is a cautionary tale for our economy. A crash, or the liquidation of assets that have grown unimpeded by economic reality (as if there were more nutrients in the ecosystem than there actually are), looks to academics and bureaucrats — and just about everyone else as well — like the system breaking down. It is actually the system fixing itself.

Food for thought.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.