My guest today is David Cheval. Cheval was an inside witness to Richard Dennis and Bill Eckhardt’s famed Turtle experiment. Through the involvement of his former wife, famed original TurtleTrader Liz Cheval, David Cheval’s history and background for the Turtle story comes from a unique vantage point.

The topic is Turtle Trading.

In this episode of Trend Following Radio we discuss:

- Events surrounding the Turtle experiment, including his own interesting part in alerting his former wife to the opportunity (he is still an investor in her firm)

- Cheval’s progression from a runner on the Chicago pits, to the formation of his CPO (Dearborn Capital Management), to his career in law today

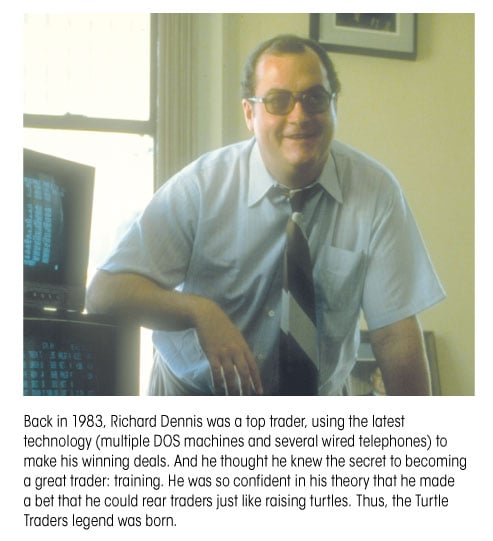

- The presence of Richard Dennis on the Chicago Board of Trade in the years prior to the Turtle experiment

- Some of the lessons that can be gleaned from some of the most successful Turtles

- The difference between volatility and risk

- Why basic trend following philosophies are timeless

Listen to this episode:

- Listen to this podcast on iTunes. (Please leave a rating!)

- Listen on Spotify.

- Listen on Stitcher.

- Libysn RSS.

- Download as MP3 by right-clicking here and choosing “save as.”

- Free Video.

Jump in!