Subscribe to Trend Following Radio on iTunes

My guest today is Jared Dillian, the author of Street Freak: Money and Madness at Lehman Brothers, named one of the top business books of 2011 by Businessweek magazine. He edits and publishes a variety of financial publications, including his own: The Daily Dirtnap. He spent a career as a trader on Wall Street and a short career before that as a Coast Guard officer. He is also an active investor, racquetball player, and an electronic music curator.

The topics are his books Street Freak: A Memoir of Money and Madness and All The Evil of This World.

In this episode of Trend Following Radio we discuss:

- Behavioral finance

- Market psychology

- Housing bubble

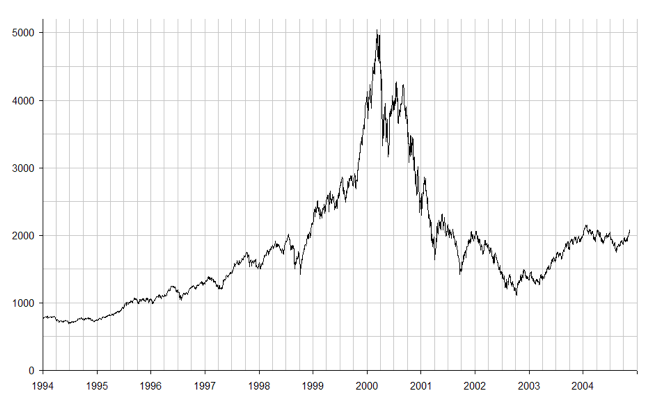

- Dot com bubble

- Lehman Brothers

- Starting your own hedge fund

Mentions & Resources:

- Jared Dillian

- “All the Evil of This World”

- “Street Freak”

- Nassim Taleb

- “Dynamic Hedging”

- “Fooled by Randomness”

- Liars Poker

- “Options Pricing and Volatility”

- Dick Fuld

- @dailydirtnap

Listen to this episode:

- Listen to this podcast on iTunes. (Please leave a rating!)

- Listen on Spotify.

- Listen on Stitcher.

- Libysn RSS.

- Download as MP3 by right-clicking here and choosing “save as.”

- Free Video.

Jump in!