Trend Following™ Flagship Trading Systems & Course

Trend Following™ Flagship Trading Systems & Course

$2,997.00

• 6 months custom email support

• Core systems trading modules

• Exchange traded funds (ETF) module

• LEAPs options module

• Money management module + more

All features below

Trend Following™ Flagship Trading Systems & Course

“The way I see it, you have two choices–you can do what I did and work for 30-plus years, cobbling together scraps of information, seeking to create a money-making strategy, or you can spend a few days reading Covel’s book [Trend Following] and skip that three-decade learning curve.”

–Larry Hite

“If there was a strategy that I would want to employ right now, if someone put a gun to my head, I’d say simple trend following strategies. They are not too popular today… They will probably do very well in the next 5 to 10 years.”

–Paul Tudor Jones

The Wall Street industrial complex, media industrial complex and political industrial complex don’t care whether you are alive or dead. They just want your money. Their game is nonstop misinformation and scams: The Fed, Dot-Com Bubble, Great Financial Crisis, interest rate manipulation, Madoff, CNBC, Bloomberg, Cramer, buy and Hope, the Efficient Market Hypothesis, Wall Street fees, candlesticks, Elliott Wave, 5-minute bar trading, bubbles, inflation, currency debasement and financial engineering to the moon. To defeat that and make the big money a severe trend following attitude is needed:

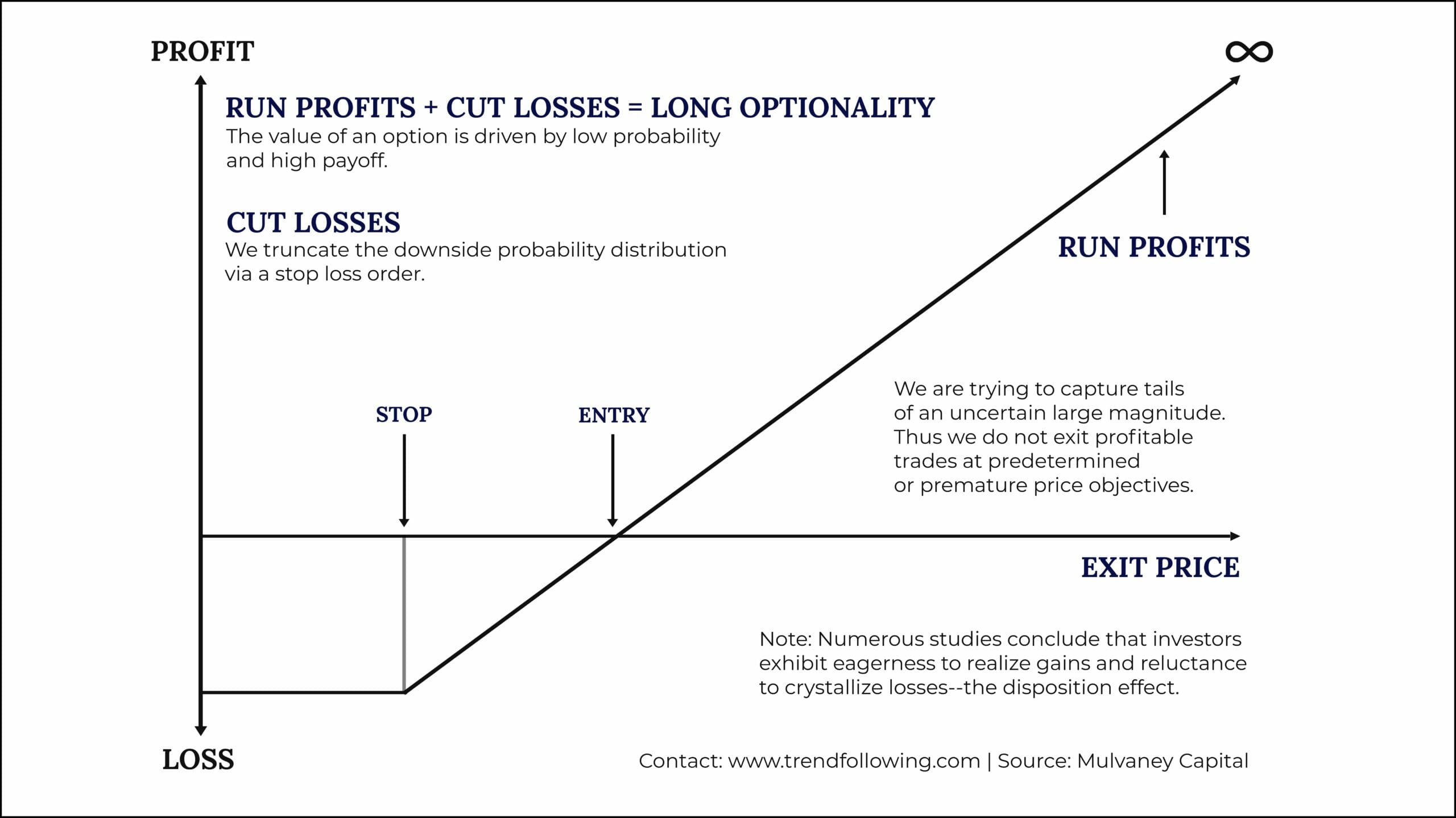

Let’s break down the term trend following into its components. The first part is trend. Every trader needs a trend to make money. If you think about it, no matter what the technique, if there is not a trend after you buy, then you will not be able to sell at higher prices. Following is the next part of the term. We use this word because trend followers always wait for the trend to shift first, then follow it. Every good trend following method should automatically limit the loss on any position, long or short, without limiting the gain. Whenever a trend, once established, reverses quickly, there is always a point, not far above or below the extreme reached prior to the reversal, at which evidence of a trend in the opposite direction is given. At that point any position held in the direction of the original trend should be reversed or at least closed out—at a limited loss. Profits are not limited because whenever a trend, once established, continues in a sustained fashion without giving any evidence of trend reversal, the trend following principle requires a market position be maintained as long as the trend continues.

• How does trend following win in the zero-sum game of trading?

• Why has it been the most profitable style of trading?

• What is the philosophical framework of trend following success?

• What are the timeless rules principles?

• What is the trend following view of human behavior?

• Why is it enduring?

Michael Covel teaches the trend following rules to answer those questions and it all starts with this:

Trend following is built around a network of relatively unknown traders who the mainstream press virtually ignores and that has not changed for decades. Michael Covel solves the mystery.

Trend Following™ Flagship Trading Systems & Course

Michael’s training and systems are for:

- Lifelong learners of any age.

- Brand new investors and traders.

- Professionals and institutional investors.

- Buy and holders.

- Equities, FX (Forex), ETFs, commodities, LEAPs and futures traders.

- Fund managers and RIAs.

- Technical traders and chartists.

- College students.

- Retirees.

- Anyone seeking above average profits in up, down and black swan markets.

Essential truths:

- No one can predict the future.

- If you can take the would-be, could-be, should-be out of markets and look at what is actually happening you have a big advantage.

- What matters most can be measured, so always count.

- You don’t need to know when something will happen to know that it will happen.

- Prices can only go up, down or sideways.

- Losses are a part of life.

- There is only now, so follow the trend.

To be clear trend following is …

- … not prediction.

- … not 5-minute, 15-minute or 1-hour bars.

- … not day trading.

- … not RSI or support and resistance.

- … not candlesticks.

- … not Wyckoff or Gann.

- … not point and figure.

- … not ascending or descending triangles.

- … not mean reversion.

- … not a high winning percentage.

- … not swing trading.

- … not a 5-day holding period.

- … not news, fundamentals or discretion.

- … not one market alone.

You receive step-by-step solutions that answer:

- Portfolio: What market do you buy or sell?

- Bet Sizing: How much of a market do you trade?

- Entry: When do you buy or sell a market?

- Exit: When do you exit a losing trade?

- Exit: When do you exit a winning trade?

This is a mental sport, yet one that can be learned, like the TurtleTraders. You do not need to be a math genius to be a Trend Following™ trader. Good trading rules are not complicated. A famed trend follower on simplicity: “I’m very uncomfortable with black box trading where I’m dealing with algorithms I don’t understand. Everything we do we could do on the back of an envelope with a pencil.”

This is for all markets and instruments across all countries:

- Stocks: S&P, SSE Comp., Nikkei 225, DAX, AAPL, TSLA, FB, etc.

- Bonds / Interest Rates: Eurodollar, 10-Year T-Note, Bund, etc.

- Currencies / FX / Forex: USD, EUR, JPY, GBP, AUD, CHF, CNY, etc.

- Cryptocurrencies: Bitcoin, Ethereum, etc.

- Metals: Gold, Silver, Copper, etc.

- Energies: Oil, Natural Gas, etc.

- Agriculturals: Wheat, Corn, Soybeans, etc.

- Softs: Coffee, Sugar, Cotton, etc.

- Meats: Lean Hogs, Feeder Cattle, etc.

- Futures.

- Commodities.

- ETFs.

- LEAPS Options.

“How can I trade those markets? I know nothing about them!”

It does not matter if you’re trading stocks or soybeans. Trading is trading, and the name of the game is to make money, not get an A in “How to Read a Balance Sheet.” It’s not about predicting when the S&P might crash or Tesla’s 3rd quarter sales numbers. Instead of trying to evaluate fundamentals that never end, trend following trades the market prices themselves. You are now an expert in all markets. Big money making starts with trends, or waves. Anyone who makes significant money rides waves. But no one can predict the next big one. The only certainty is that when the big wave comes, trend followers will surf the new beaches. That simple-sounding ideology is instrumental for financial flexibility, as trend followers trade that same philosophy in all markets. You can storm into any moving market, be it an obscure currency or a stock in wild emerging markets. Trend following is agnostic to both the market and direction. It pursues whatever market is flowing–up or down.

All content is presented via an online password protected education platform with all written modules and audio/video modules.

| Flagship v. Standard | $2997 | $1997 |

|---|---|---|

| Custom Email Coaching | 6 months | 3 months |

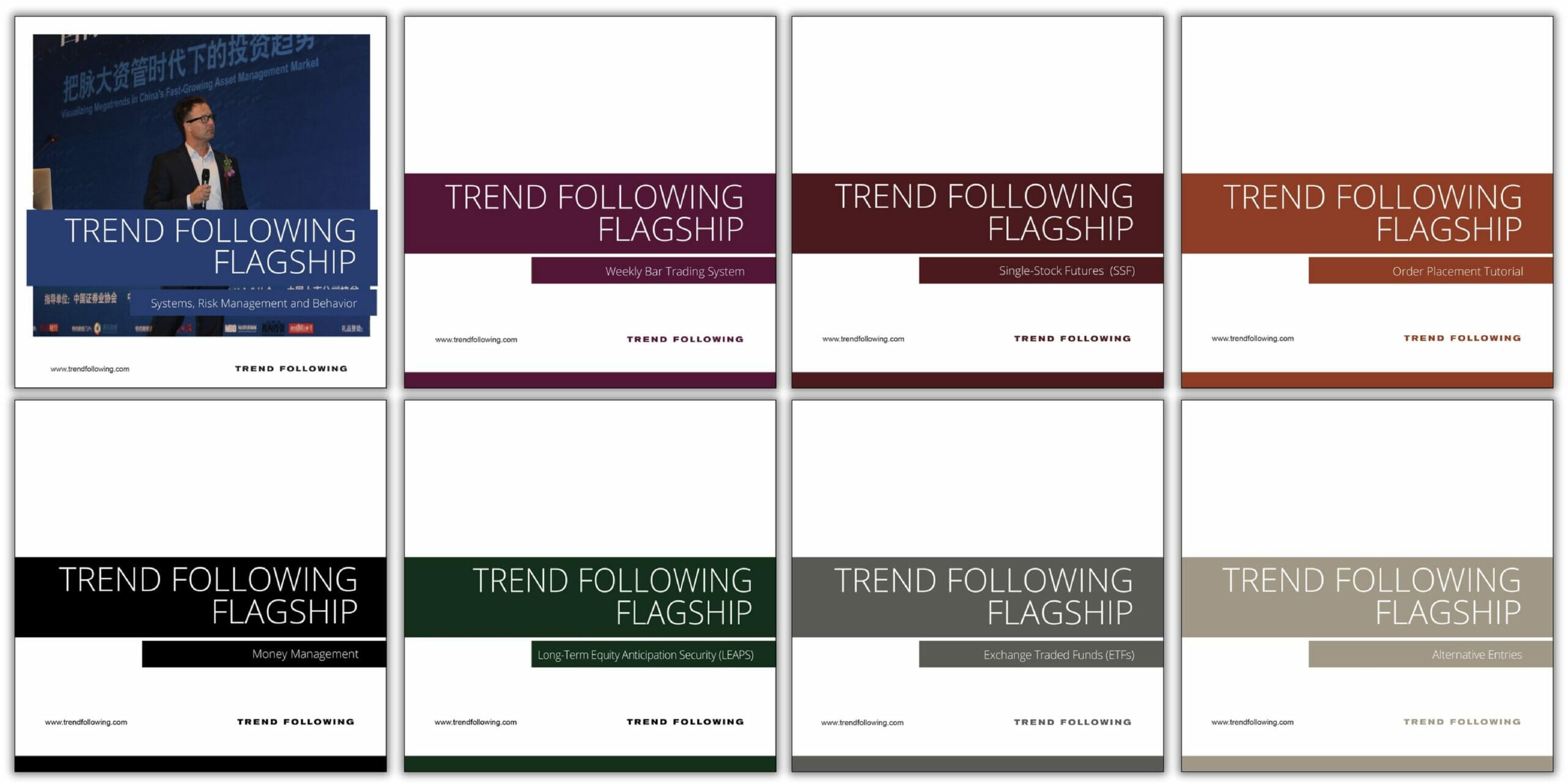

| Core Systems Trading Module | Yes | Yes |

| Exchange Traded Funds (ETF) Module | Yes | Yes |

| LEAPs Options Module | Yes | Yes |

| Money Management Module | Yes | – |

| Case Study Module | Yes | – |

| (3) Additional Trading Systems | Yes | – |

| Alternate Entries Module | Yes | – |

| Wizard Video: Video One | Yes | – |

| Wizard Video: Video Two | Yes | – |

| Wizard Video: Video Three | Yes | – |

| Wizard Video: Video Four | Yes | – |

| Trading Coach Video: Video Five | Yes | – |

Michael’s systems have been reverse engineered to answer:

- How to enter and exit at all times

- How to place stops

- How to adjust stops

- How to take a loss to avoid a larger loss

- How to balance longs and shorts

- How to adjust trades for new profits

- How to adjust on winning/losing streaks

- How to adjust risk as an account grows

- How to adjust positions for volatility

- How to handle the psychological component

- How to choose a portfolio

- How to model the great traders

- How to manage risk with a written plan

- How to trade off the closing and weekly price

- How to stay out of the market

- How to plan for a worst-case scenario

- How to trade with a small account

- How much to trade at all times

- How to evaluate total market risk

- How to diversify your account

- How to handle correlated markets

You will know at all times:

- What is the state of the market?

- What is the volatility of the market?

- What is your equity being traded?

- What is your trading orientation?

- What is your risk aversion?

You will have these proprietary trading systems:

- Classic Trend Following System I.

- Classic Trend Following System II.

- Classic Trend Following System III.

- The Weekly Trend Following System.

- Risk management all systems adjustable to your risk tolerance.

You will know every step to take, every price level to follow, every setup to execute and have every needed risk management tool to keep you in the game while positioning you for the big gain. You will also have coaching. Emails are answered within 24-48 hours. Like with your CPA or attorney–you get your answers. No extra coaching fees. Learn Trend Following™ anywhere: office, home or on the road. You always know:

- What is the opportunity in the market niche?

- What is your solution to beating the market?

- How big is the opportunity?

- How do you make money?

- How do you trade the market and profit?

- What is the competition?

- How are you better?

- How will you execute and manage?

- What are your risks?

- Why will you succeed?

Reasons why traders and investors take Michael’s training:

- Brand new trader and or investor.

- College student.

- Need ready to use trend following systems.

- Need new trend following systems.

- Need a comprehensive trend following education.

- Need confirmation for a current strategy.

- Need support. Have questions.

- Need research to validate trend following.

- Missing something in a current approach or technique.

- Seduced by bogus Wall Street approaches.

Frequently asked questions.

Starting capital.

Software issues.

Skeptics.

If you want guru secrets or easy money riches, please go away. There is no such thing. If you’re in the mood for outlandish predictions, stories about the ultimate gut trader, or what it’s like to work inside a Wall Street bank, or if you want to complain life is unfair and beg for the government to save you with a bailout—no one can help you on your path to irrelevance. If you fit any of these problematic profiles, there is a good chance my words, and my politically incorrect perspective, will give you an aneurysm. In the alternative, if you want outside-of-the-box different, the truth of how out-sized returns are made without any fundamental predictions or forecasts, this is it. And if you want the honest data-driven proof Michael’s research will provide the confidence to take a swing at making a fortune in bull, bear, and black swan markets.

“Take a simple idea and take it seriously. Then go 1000%.”

–Michael Covel

Endorsements and Success Stories

“The way I see it, you have two choices–you can do what I did and work for 30-plus years, cobbling together scraps of information, seeking to create a money-making strategy, or you can spend a few days reading Covel’s book and skip that three-decade learning curve.”

–Larry Hite, Market Wizard

“We have made Trend Following required reading for all of our employees. Michael is a great asset and a respected member of the trend following community.”

–Tim Pickering Founder and CIO, Auspice Capital Advisors

“I have to thank Mike for his in-depth research on this subject and a proven way for traders to make money – simply by following the trends. Mike’s trading system course has made positive contributions to my success in trading and managing my clients’ money.”

–Brendon W. in Chicago.

“Michael, I credit your two books as being essential to my transformation into a consistent, winning trader.”

–Andrew A. in St. Petersburg, FL.

“Trend Following” has changed my life, not only with trading, but also the way I view the world and live my life. If there is anyone who thinks trend following doesn’t work, please give them my information to contact me. I am a living, breathing example that it does.”

–Todd M. in New Jersey

“What really convinced me to follow this path is I recently met a trader that has been successfully trend trading for over five years using your methods. Thank you for making me aware of the ultimate retirement plan.”

–Mitch C. in California

“Out of all the trainers, lecturers and “gurus” I believe that none are better than Michael Covel in making complicated concepts clear and understandable. I consider Mike to be the “Best of the Best”. Mike truly cares about his students and wants us to succeed.”

–Barry N. in California.

“Years ago, famed Chicago bond trader Tom Baldwin put trading in a phrase: ‘Everybody wants the money, but whose willing to do the work?’ I know a few. One of them is Michael Covel. Michael did the yeoman’s duty no one else would do: bringing together the principles, practices and track records of trend following. In his now numerous books, courses and programs, he solidly demonstrates trend following is a viable trading and investment strategy; moreover, one that can be learned and mastered.”

–Charles Faulkner, Market Wizard Trading Coach

“I spent my professional career in the [trading] industry until my retirement in 2001. Through the years I have been asked many times for advice about how to attempt to be a successful trader. My answer: read and apply Covel.”

–Jack Z. in New York.

“Michael Covel is a rare breed. He is the only author I have come across who really understands how traders can make money, regularly and consistently over a long period of time. Unfortunately, the financial world has been hijacked by crooks, charlatans, bankers and investment advisers hoodwinking the general public into believing that buying and holding a financial asset over a long period of time is the right strategy. Michael Covel shines a light in this world and is indeed a rare breed. I cannot recommend his work enough.”

–Jad T., a trader in Chicago

“Mike Covel is not just a cheerleader for trend-following, he is the Head Coach. He understands the game, the strategy and crucially the psyche of the players. Would-be winners will ensure that they study Mike’s teachings and books before stepping onto the playing field. His books ARE required reading here for all our traders, marketers and interns.”

–Christopher Cruden, Chief Executive Officer at Insch Capital Management.

“Never mind how much money these teachings have made me. Their biggest benefit so far has been how much they have SAVED me. Trend following helped me sail through the Global financial crisis relatively unscathed. Mike truly has access to some of the greatest trend following minds around, no mean feat given the majority of these players shun the public eye. I have find his guidance from afar extremely helpful.”

–Darren R. in Australia.

“I started trading roughly 10 years ago as a typical discretionary trader. I eventually realized my emotions were too strong and I lived in fear, glued to the screen watching every tick of market data. I hated it, but I felt like I had to do it. I spent hours researching stocks for the fundamentals, etc. As a software engineer and private pilot, I knew there had to be a better way. 100% systematic trading has helped me get my life back.”

–Michael H.

“I decided to contact Mike and work with him one on one. This experience has put me in a new league and really helped me focus on my weak areas which were risk management and portfolio selection. I would recommend any trader who is not where they want to be to start with Mike.”

–Steve Burns

More Trend Following Benefits

“I spent over a decade assembling and curating trend following systems, research and education. You take my years and get to the big money opportunity faster. That’s a great deal. Win, win.”

–Michael Covel

The philosophical foundation of Michael Covel’s work and attitude presented in the form of a golf commercial:

Huge Returns: Financial freedom. The best returns over the last 50 years are from trend following.

Onerous: Michael serves clients by performing the onerous work for them. That means flying around the world and gaining an audience with the best traders on the planet. Sitting down with them, learning with them and figuring out what they do to make their trend following profits.

Modeling: Trading is a teachable science, not an innate talent. If you want success you must copy what the great traders do. The right trading behaviors can be installed into a person like software installed on a PC.

No Prediction: If somebody promises they can predict tomorrow, watch out. Predictions are an early warning sign, like locusts or plague.

No Stories: Cocktail parties are filled with people tossing around stories all designed to make you think that they have figured out a market direction or market play. Stories and stock tips are a massive waste of time.

Vacation Trading: Means of market profits: laptop + Internet. Minutes a day is it. Automation. Mechanical. Desert isle. Freedom. Manage your trades from anywhere in the world. Geography is not your master.

End-of Day System: You don’t sit in front of a computer to trade. You know before the open whether there is an order that day. You place orders before the market opens. Once orders are placed, you don’t need monitor the market the rest of the day.

Timeless v. Timely: You want a trading strategy that worked 50 years ago or 40 years ago or 30 years ago or 20 years ago or 10 years ago or five years ago or one year ago. You want timeless principles that work no matter what market is moving either up or down. Is that doable? Absolutely.

Clear Strategy: Making money in the markets isn’t about trading technology or software. It’s about ideas. It’s about a mindset. Trend trading is all about opportunity taking not opportunity making. If you don’t have a strategy, if you wake up each day like the millions of panicky sheep, scared that they might miss something, petrified they don’t know something–stop now because you’re not going to make it.

Fully Disclosed: Michael’s trading logic is fully disclosed so you’ll know exactly why each trade is being placed. This is not a black-box system where you don’t know how it all works.

Unique: Who else is crazy enough to donate 20 years of their life in a pursuit to get behind the curtain? Michael’s access is unique.

Desire: If you’re stuck it may help to take a page from the book of those who have done it. They often share key traits: talent, passion, drive, and discipline. But they share another characteristic often overlooked: courage.

Robust: You don’t need dozens of indicators and theorems. Great traders concentrate on core concepts.

Think Probabilities: Winners think about how much they can lose. Losers think about how much they can win. Those simple words are mission-critical. Process versus outcome.

No Opinions or Egos: Do you have a big ego? Do you trade to impress people? Do you trade to be right? Egos, impressing people and trying to be right are the kiss of death when it comes to making money in the markets.

No Favorite Stocks: Do you really care what market you make money in? If you make all of your money hypothetically shorting the euro, so what? If you make all of your money for a particular year being long Apple stock, so what? Don’t have favorites. Favorites are the sure sign of a inexperienced trader.

The Need: Trend following is not a want or a luxury.

The Right Way: How do you avoid information overload? How do you decipher the right investing hieroglyphics? How do you choose what to leave in and out? Looking at data is one thing, but knowing what to do with it is different. Traditional investing beliefs have become discredited, challenged by experience, and factually disproven by data-driven analyses.

K.I.S.S.: Academics and government types hate simple. Sophistication and complexity is how they justify their degrees (and the years spent wandering around campus cafeterias). A degree in math or statistics, or economics is not needed. Staff, premises, and expensive overhead are not required.

Firehose to the Mouth: Learning is not a straight line. You need to be exposed to as much material on a subject like trend following as possible. This allows you to take in details you might not consciously see.

Heretics: Clinging to labels and status will stunt your learning. Intellectual idiots like being told. Don’t be that. Anyone can learn and unlearn. Be a sponge. Stepping out of bounds is the winning hand. Individual self-reliance is it.

Embrace Disorder: Surprise events, uncertainty, chaos, and even primal fear might not appear to be the states needed for market success, but they are. Great investing, great trading, great trend following embraces the shock and so should you.

Behavioral Finance: Human beings are not rational.

Random Jumps: Markets are not efficient. They are driven by random jumps. Rare and unpredictable large deviations from the normal. Traditional investing is built upon the bell curve. It’s all wrong.

The Babe Ruth Parallel: “What is striking is that the leading thinkers across varied fields — including horse betting, casino gambling, and investing — all emphasize the same point. We call it the Babe Ruth effect: even though Ruth struck out a lot, he was one of baseball’s greatest hitters.” His home runs paid for the strikeouts, but people don’t get that as one Silicon Valley venture capitalist notes: “The Babe Ruth effect is hard to internalize because people are generally predisposed to avoid losses. Behavioral economists have famously demonstrated that people feel a lot worse about losses of a given size than they feel good about gains of the same size. Losing money feels bad, even if it is part of an investment strategy that succeeds in aggregate.” You can’t have trend following grand slams without a fair share of trend following strikeouts. Accept that principle and you are on your way to understanding how 20x, 50x, etc. can be made on your money.

Questions? Email.

Risk Disclaimers

Trend Following™ and TurtleTrader® can’t promise you will earn the returns of traders, charts or examples (real or hypothetical) stated. All past performance is not necessarily an indication of future results. Data presented is for educational purposes. Trend Following™ products are provided for informational purposes only and should not be construed as personalized investment advice. All data on this site is direct from the CFTC, SEC, Yahoo Finance, Google and disclosure documents by managers mentioned herein. Trend Following™ assumes all data to be accurate, but assumes no responsibility for errors, omissions or clerical errors made by sources. Our testimonials are the words of real customers received in real correspondence that have not been paid for their testimonials. Testimonials are sometimes printed under aliases to protect privacy, and edited for length. Claims have not been independently verified or audited for accuracy. We do not know how much money was risked, what portion of their total portfolio was allocated, or their exact positions. We do not claim that the results experienced by such customers are typical and you will likely have different results. Trend Following™ is not registered as a securities broker-dealer or an investment adviser. This information is not designed to be used as an invitation for investment with any adviser profiled. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund. Further, Trend Following™ cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing. Additionally, Trend Following™ in no way warrants the solvency, financial condition, or investment advisability of any security or instrument. In addition, Trend Following™ accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as a basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.