Feedback in:

OK, Michael. You asked for it. My biggest challenge is the learning curve, and that time commitment. Background information: I’m a physician, approaching 70, still in part-time practice, and quite active. Since around 2008 I’ve taken more interest in my life savings, and tried to learn how to better manage my investments. It’s not been a disaster but I’ve not done that well. Yet I’ve spent, literally, tens of thousands of dollars, read some 20+ books, subscribed to newsletters, tried investment advisors, spent endless hours looking at charts, balance sheets, company profiles and analysts’ reports to get this far. Fortunately, through [name][ membership, I recently ran across your presentation last year at their meetings and listened to it. I’ve been learning about you since. I’m just finishing up your book Trend Following and now have discovered your websites and Flagship course. And I just finished reading through most of your trend following website. I tend to be an independent thinker. I’m an anarcho-capitalist. I have a couple of patents to my name and am trying to monetize them by starting a business. I’m regularly reading 10+ investment newsletter advisors every day. I’m using [name] for entry and exits. So it feels like I’m already juggling a few balls in the air as is. Somehow it never registered to me that many of the famous traders I’ve read about and admired like Paul Tudor Jones, Ed Seykota, Bill Dunn, Tom Basso and George Soros were all trend followers and trend traders. Going through your book and the website, it looks to me that if I sign up for your Flagship product, I will be committing to a solid month to 3 months of dedicated learning and study to implement a personalized system of investment using trend following. Don’t get me wrong. I ABSOLUTELY BELIEVE THAT TREND FOLLOWING WORKS. But I do realize that stops, risk management, capital management and dedicated systematic attention to detail will be the fundamental requirements to any success with this kind of system. But I honestly wonder if I have the time that I can commit to developing and running this kind of system. Will I be able to juggle this along with all those other things I have going? I wonder if I would be better off placing a percentage of my capital with a manager like Dunn Capital Management (or maybe somebody else?), and focus my efforts with the remainder of my capital doing long equity trading with my existing investment advisors. But maybe you’re going to tell me that I should make the effort to learn trend following through your Flagship product, not only to do my own trend following trading, but because you also feel it will help me with my long equity trades in the remainder of my portfolio. Time is the one commodity that becomes more precious to us every day we get older. I’d be pleased to hear what thoughts you might have regarding this conundrum.

Ted T.

Great feedback.

I can help if you are investing with someone or DIY.

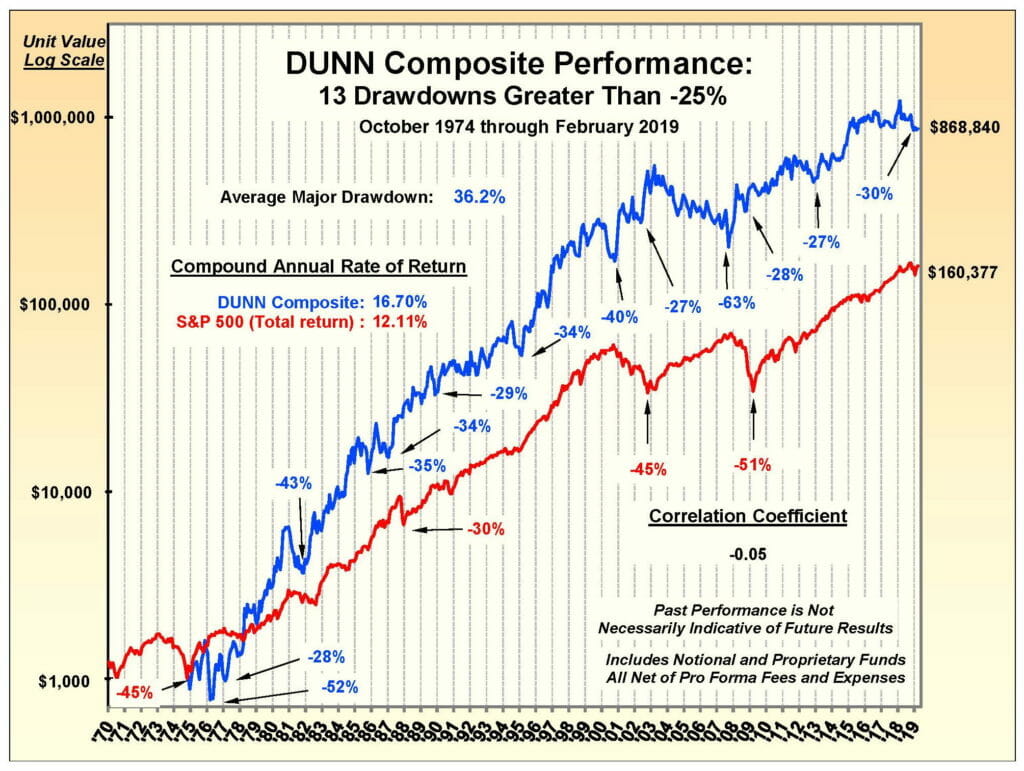

A great informational chart…

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.