Feedback in:

Hi Michael,

I am a reader of your blog, your books and I recently started listening to your podcast (review coming soon).

You inspired me to build and trade the system… with confidence and discipline. I have a few years of discretionary trading experience, with no consistent profits.

So I’d like to start trading a mechanical trend following system.

Here is the system I came up with, inspired by [name], with my optimization of markets choice and parameters.

Enter long if EMA 150 is above EMA 350 and if we have a new 120 days High, on a closing basis. Stop 3 ATRs below last high, on close. Reverse for short.

Apply it to commodities and forex (it unfortunately is losing money on S&P and TNOTES in backtests, also some markets are not available with my broker, so this uses what I had available, about 15 markets, corn, wheat, soybean, gold, oil, forex 4 majors and a few crosses).

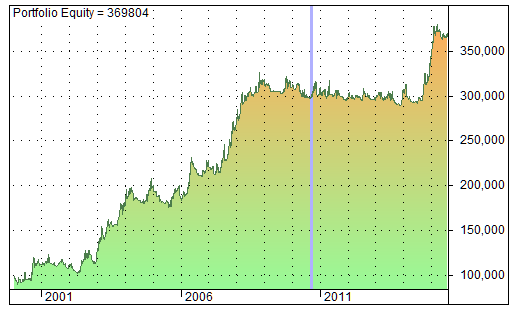

Here is how the result looks like:

Compounded Annual Rate 8%, max drawdown 17%, so CAR/MDD around 0.50. This is achieved with 2% risk per trade. Position size based on ATR. Results look good, but there is a 6 year drawdown or flat period. I guess most trend following systems had a worse period, but was it that bad with other systems, too? My key question… do you think this system is good enough to trade it? I know this is my own decision, but I guess you have sees tens of trend following systems… is this system OK? Or shall I keep searching for a better one? Please advise. Thanks a lot. To be clear, of course I am not asking for an investment advise. I am asking for your perspective on the quality of this system. Thank you! I will be really grateful for your perspective.

For reference, the list of markets:

FCOPPER

FGOLD

FCORN

FNATGAS

FOIL

FRICE

FSOYBEAN

FWHEAT

AUDUSD

EURUSD

GBPUSD

NZDUSD

USDCAD

USDJPY

AUDNZD

EURAUD

EURGBPThe parameters are channel length (120 days high to go long) and two EMAs length and ATR coefficient. All parameters were solid and stable, i.e. they worked OK on a wide range, e.g. any channel above 50 is profitable. ATR any from 2.5 to 6 is profitable, etc. I also did not cherry-picked the best optimized result, but I took parameter values that had the most surrounding values positive. If I remove EMA filter, i.e. just take 120 days high, without waiting for EMAs cross, the profits (return rate) is more is less the same (slightly smaller), but drawdowns are much deeper. So I keep the EMA cross as a filter. From list of markets I removed S&P, TNOTES and DAX and Bund as it was losing money there, consistently. To make money on S&P this system needs 7*ATR stop, but then loses on commodities and forex. Would you trade it? Is the dinosaur system you are offering much superior to this one? (I noticed in the PDF you shared, the list of futures, it was tested on markets that I have no access to, such as gasoline… I wonder what would be test results of your system on my list of markets).

Thanks!

[Name]

Welcome to your journey! Remember if You are just starting out it is a good idea to read like crazy.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.