Consider from The Babe Ruth Effect: Frequency vs Magnitude (PDF):

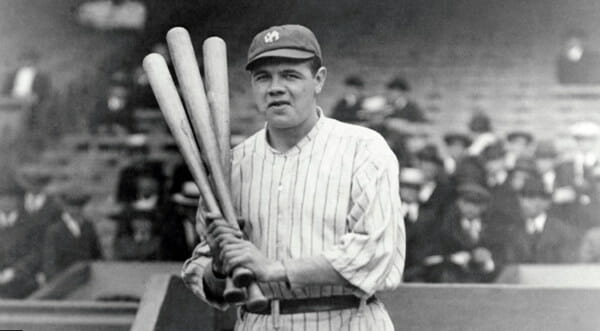

“Building a portfolio that can deliver superior performance requires that you evaluate each investment using expected value analysis. What is striking is that the leading thinkers across varied fields — including horse betting, casino gambling, and investing — all emphasize the same point. We call it the Babe Ruth effect: even though Ruth struck out a lot, he was one of baseball’s greatest hitters.”

Chris Dixon adds:

…about ~6% of investments representing 4.5% of dollars invested generated ~60% of the total returns. Let’s dig into the data a little more to see what separates good VC funds from bad VC funds.

Further from Dixon:

The home runs for good funds are around 20x, but the home runs for great funds are almost 70x. As Bill Gurley says: “Venture capital is not even a home run business. It’s a grand slam business.”

Speculation is not about a consistent 1% a month. That’s fantasy.

Check out the resources page for Trend trading for dummies pdf.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.