Tim Pickering of Auspice Capital offers wisdom:

Investments can be broken down into essentially two types: Convergent and Divergent.

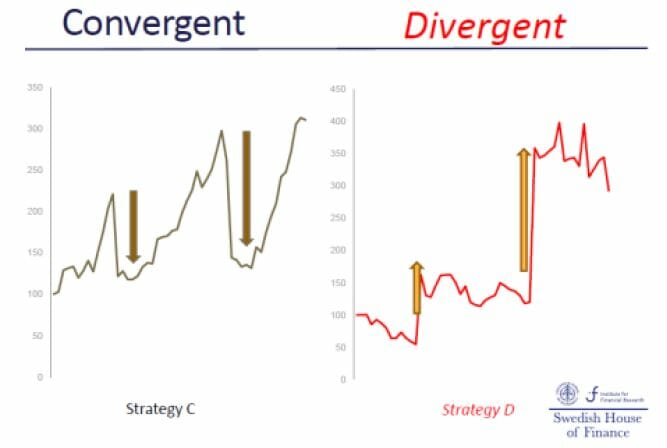

Convergent risk tasking strategies are characterized by many small gains but also occasional devastating losses. These strategies are generally based on market fundamentals and the human tendency for logical sense. The returns look a lot like the equity markets. Convergent strategies are comfortable for people because many small gains feed the human need for constant gratification (ex. Yield, making returns every month, quarter, year). Most traditional and alternative asset are convergent. See Chart.

Divergent strategies [like Trend Following] do something different. They are characterized by many small losses but also with occasional big wins. These strategies are generally based on a systematic, repeatable investment process that has no fundamental bias. They are agnostic to market direction. The returns look like paying option premium or time value before the hockey stick gain of a call option. The most common way to achieve this return stream is trend following (CTA / Managed Futures). Divergent strategies go against human need as they feel like a lot of small paper cuts before the payoff. They are hard to get your head around as we all want constant gratification.

But the real beauty of the 2 strategies is that the losses in one often get covered by the gains of the other. The power is using both. They are not only non-correlated, they are negatively correlated at critical times. Ask yourself – what is Divergent in my portfolio?

Great explanation of Trend Following.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.