The case for clearly defining your exit strategy

By Ross Hendricks

It pays to pack a parachute.

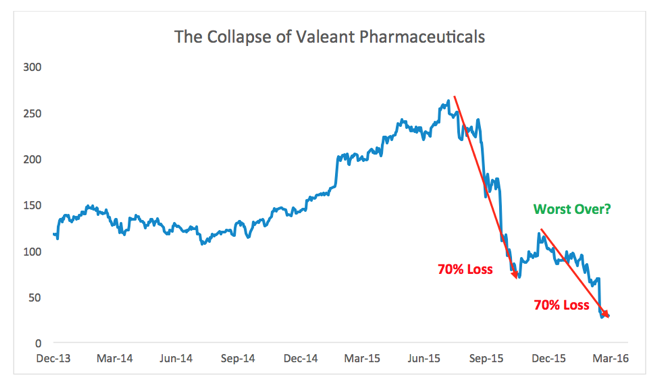

A host of high profile money managers learned that the hard way recently when their investments in Valeant Pharmaceuticals reversed course.

For example, the Sequoia fund returned four times as much money as the stock market from 1970 through July 2015. What’s more, they did it with less volatility and lower drawdowns.

But Sequoia Fund’s brilliant performance came to a halt in the last year because of a single investment in Valeant.

At the peak, Valeant made up more than 30% of Sequoia’s portfolio. When Valeant began losing altitude, Sequoia’s managers failed to consider an exit plan. Instead of pulling the ripcord and exiting their positions, they added 1.5 million shares at the end of 2015 – only to see the stock nose dive a further 70%.

Trust the process

The lesson here is clear. You won’t always be right, and you must have a process in place for the inevitable times when you will be wrong.

A rules-based investment process like trend following establishes predefined exit points before entering each position. This process defines exactly how much capital is at risk with each position across the portfolio. That allows you to cut losing trades quickly – before they ever have the opportunity to grow into career-ending losses.

Here’s how a simple trend-following strategy could have worked on Valeant:

Using a 200-day moving average would have gotten you into the stock during much of its move higher through 2013 and 2014. Then you would have gotten out of the stock above $200 per share – before it lost nearly 90% of its value.

With this kind of strategy, you will give up some profits when stocks fail to trend higher, like in 2014. But giving up this relatively small upside allows you to systematically avoid disastrous losses.

That’s a small price to pay for a softer landing.

Ross Hendricks is a senior portfolio consultant.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.