Michael’s Flagship Training.

Michael’s Books.

Michael’s Podcast.

Michael’s Take on Software.

Michael’s Blog — More Reviews.

Michael’s Flagship Training.

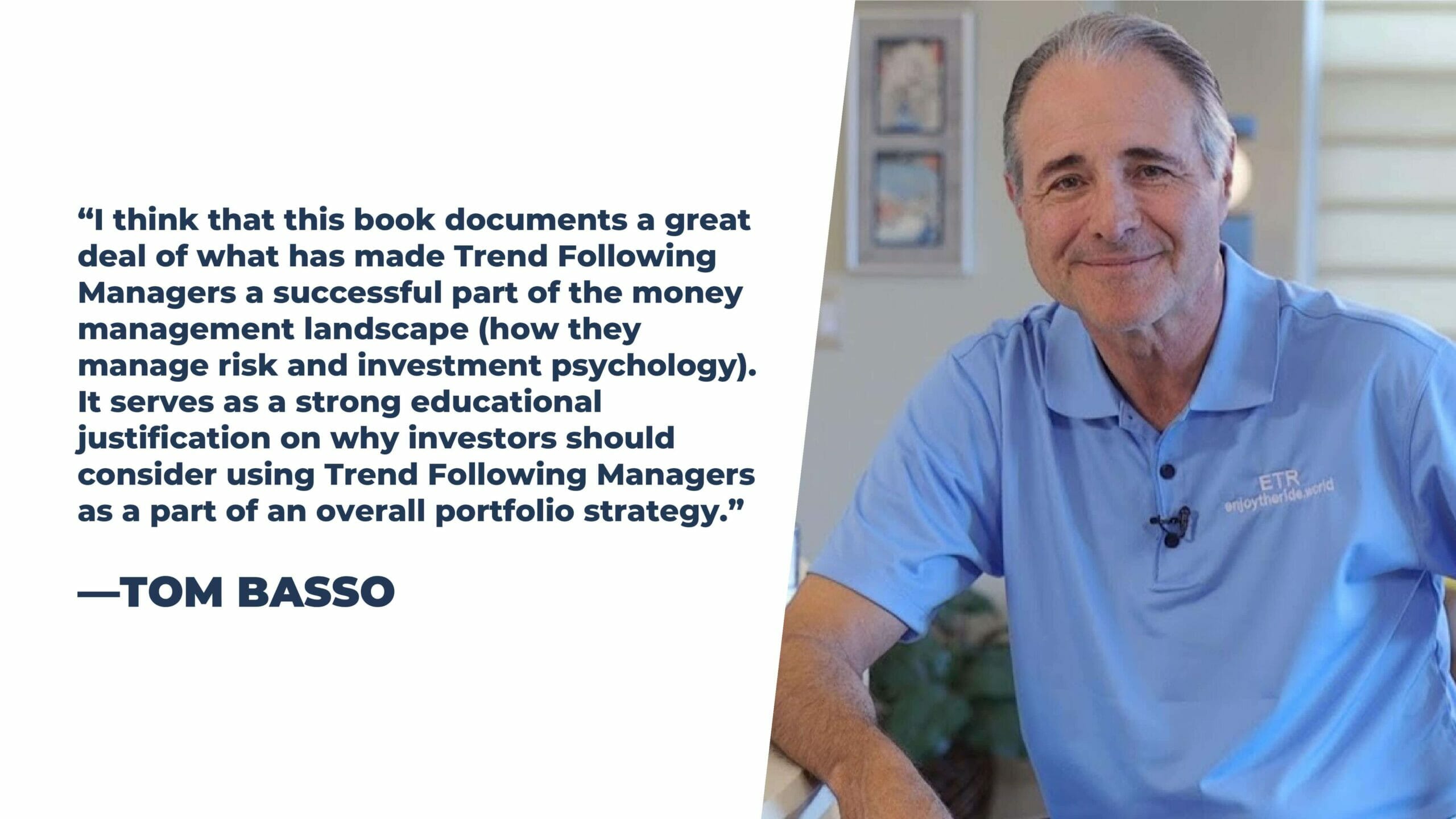

Michael’s Books.

Michael’s Podcast.

Michael’s Take on Software.

Michael’s Blog — More Reviews.