“Cut short your losses, and let your profits run on.”

–David Ricardo, legendary political economist

Source: The Great Metropolis, 1838

David Ricardo (19 April 1772 – 11 September 1823) was an English political economist, often credited with systematising economics, and was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and John Stuart Mill. According to an 1838 book, The Great Metropolis, Volume 2 (PDF), Ricardo had certain golden rules:

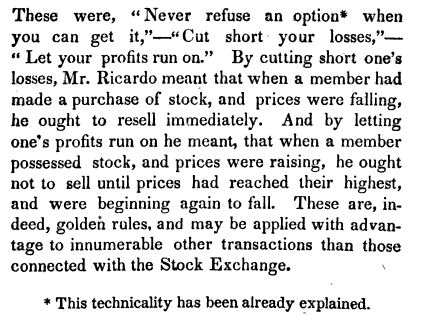

“As I have mentioned the name of Mr. Ricardo, I may observe that he amassed his immense fortune by a scrupulous attention to what he called his own three golden rules, the observance of which he used to press on his private friends. These were, “Never refuse an option when you can get it, cut short your losses, let your profits run on.” By cutting short one’s losses, Mr. Ricardo meant that when a member had made a purchase of stock, and prices were falling, he ought to resell immediately. And by letting one’s profits run on he meant, that when a member possessed stock, and prices were raising, he ought not to sell until prices had reached their highest, and were beginning again to fall. These are, indeed, golden rules, and may be applied with advantage to innumerable other transactions than those connected with the Stock Exchange.”

Said another way: TREND FOLLOWING.

The big WHY trend following works:

- Speculation as a Fine Art; published 1880 (PDF)

- A Century of Evidence on Trend Following Investing; AQR Capital Management (PDF)

- Two Centuries of Trend Following; Capital Fund Management (PDF).

- Memoirs of Extraordinary Popular Delusions; published 1841 (PDF)

- Kieron Nutbrown, former head of global macro fixed income at First State Investments in London, produced this chart (PDF) showing global stocks over the past 500 years and demonstrates how prices have fared through wars, revolutions and depressions. His work is in the 2017 Trend Following too.

- The Pit and the Pendulum Part I; Winton Capital (PDF)

- The Pit and the Pendulum Part II; Winton Capital (PDF)

- The Pit and the Pendulum Part III; Winton Capital (PDF)

- Bulls and Bears (PDF)

- S&P 500 Corrections & Bear Markets Since 1928 (PDF)

- Largest Quarterly S&P Losses Since 1980; Sunrise Capital (PDF)

- The Decades (PDF)

- Dickson Watts: Speculation as a Fine Art

- Humphrey Bancroft Neill: Tape Reading and Market Tactics

- Victor Niederhoffer, Nassim Taleb and Malcolm Gladwell: Blowing Up

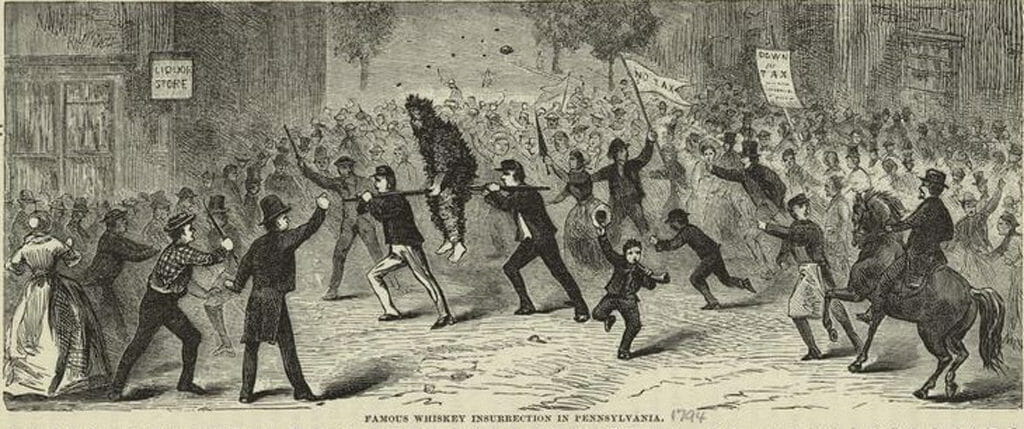

- Business Booms and Depressions Since 1775 (PDF)

That is detail no college professor ever includes in a syllabus. The black swan…

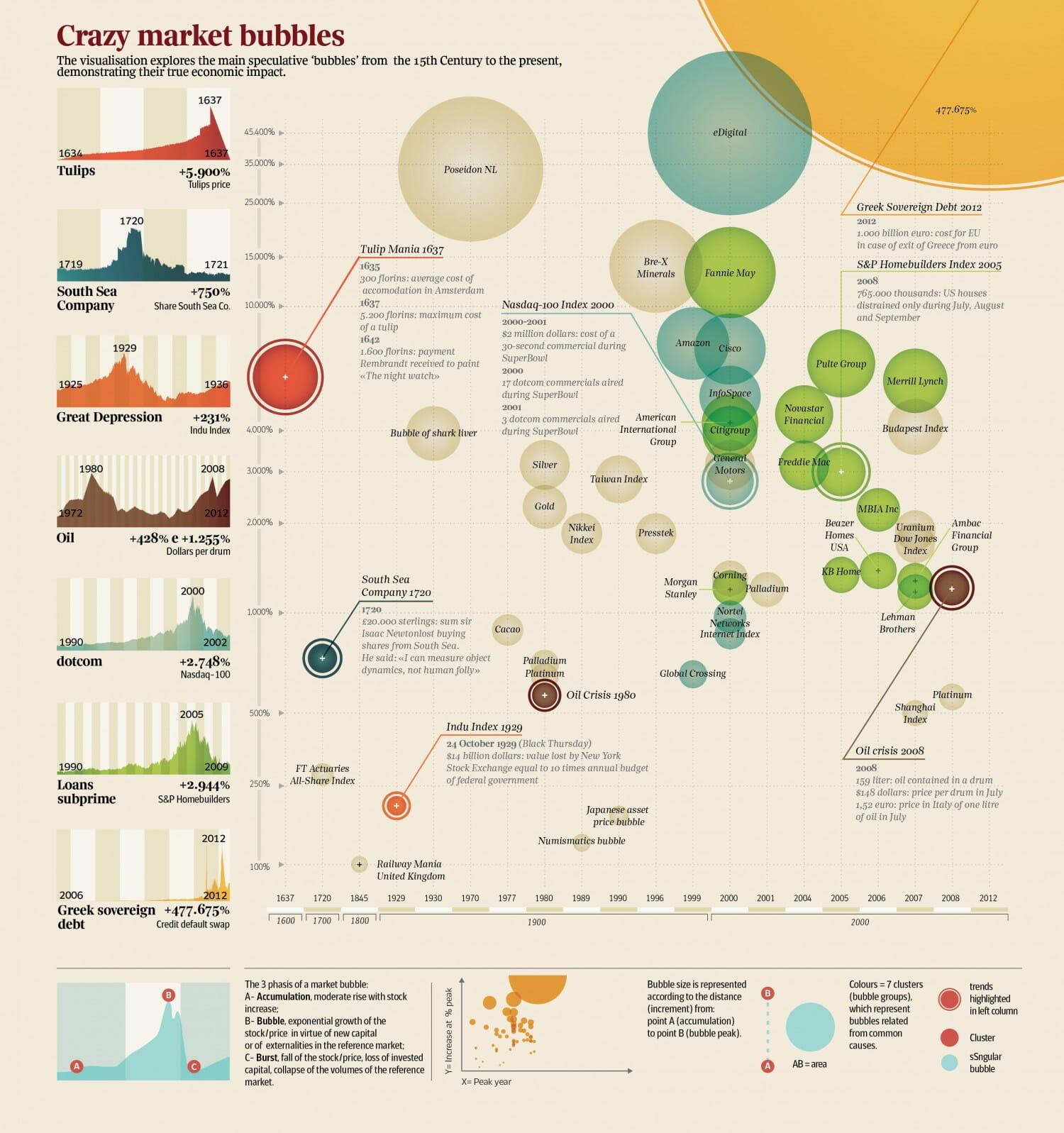

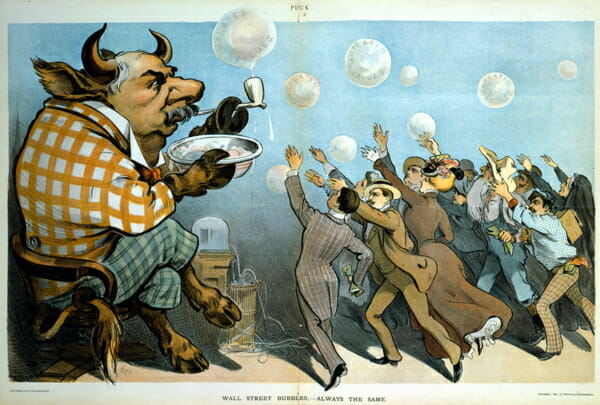

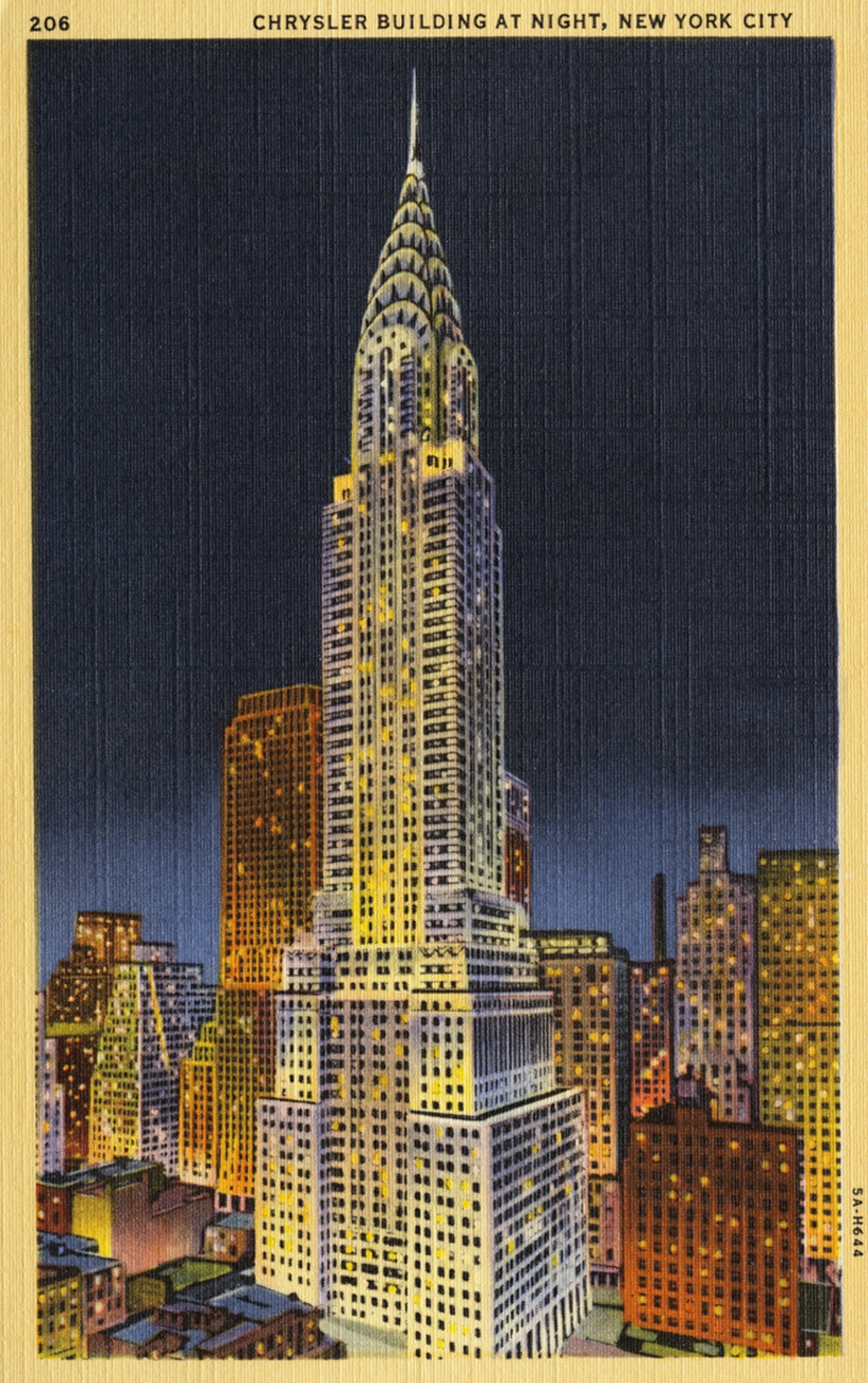

Bubbles Visualized

A selection of market bubbles visualized.

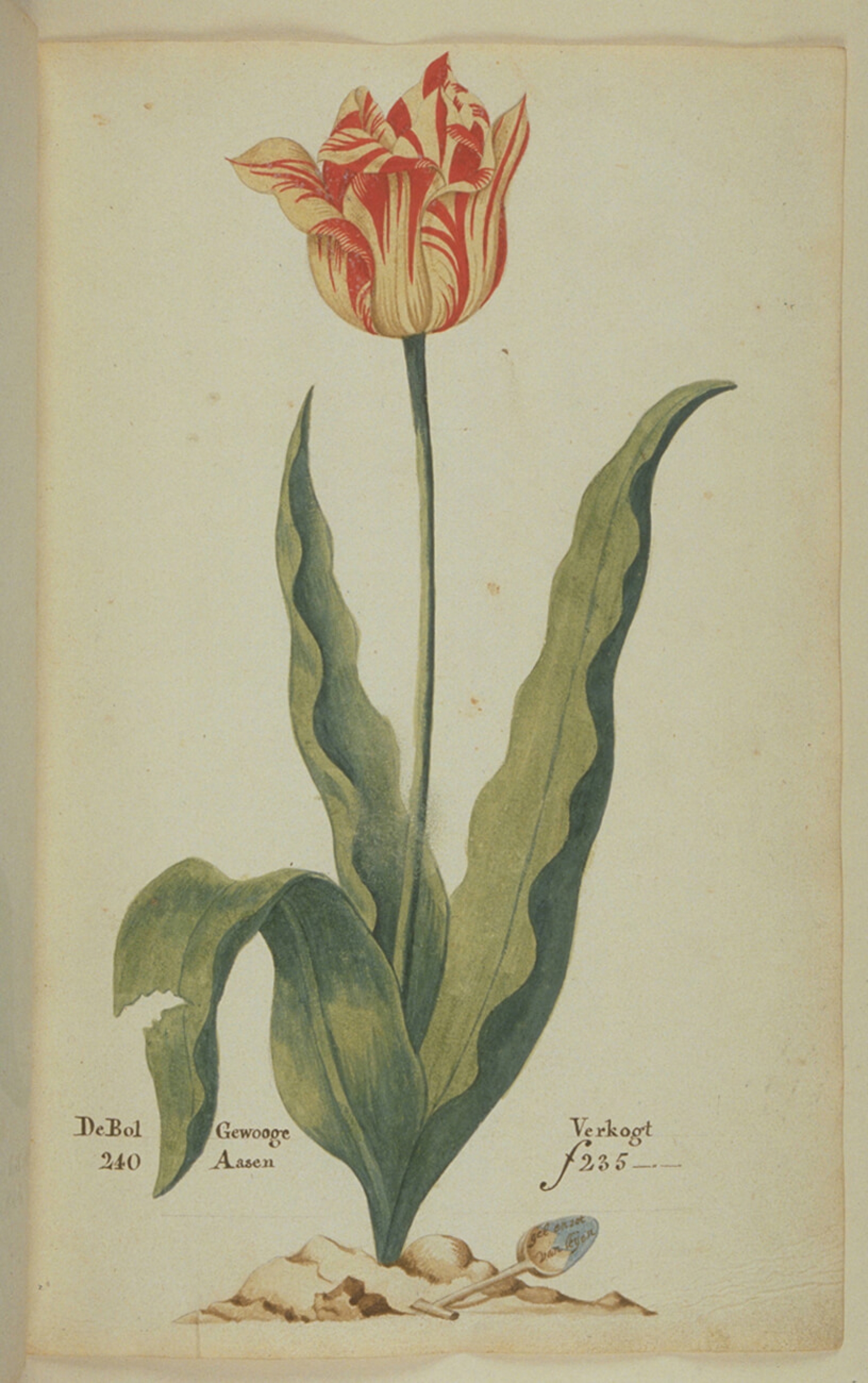

Tulip Mania

Wageningen UR Library, Special Collections

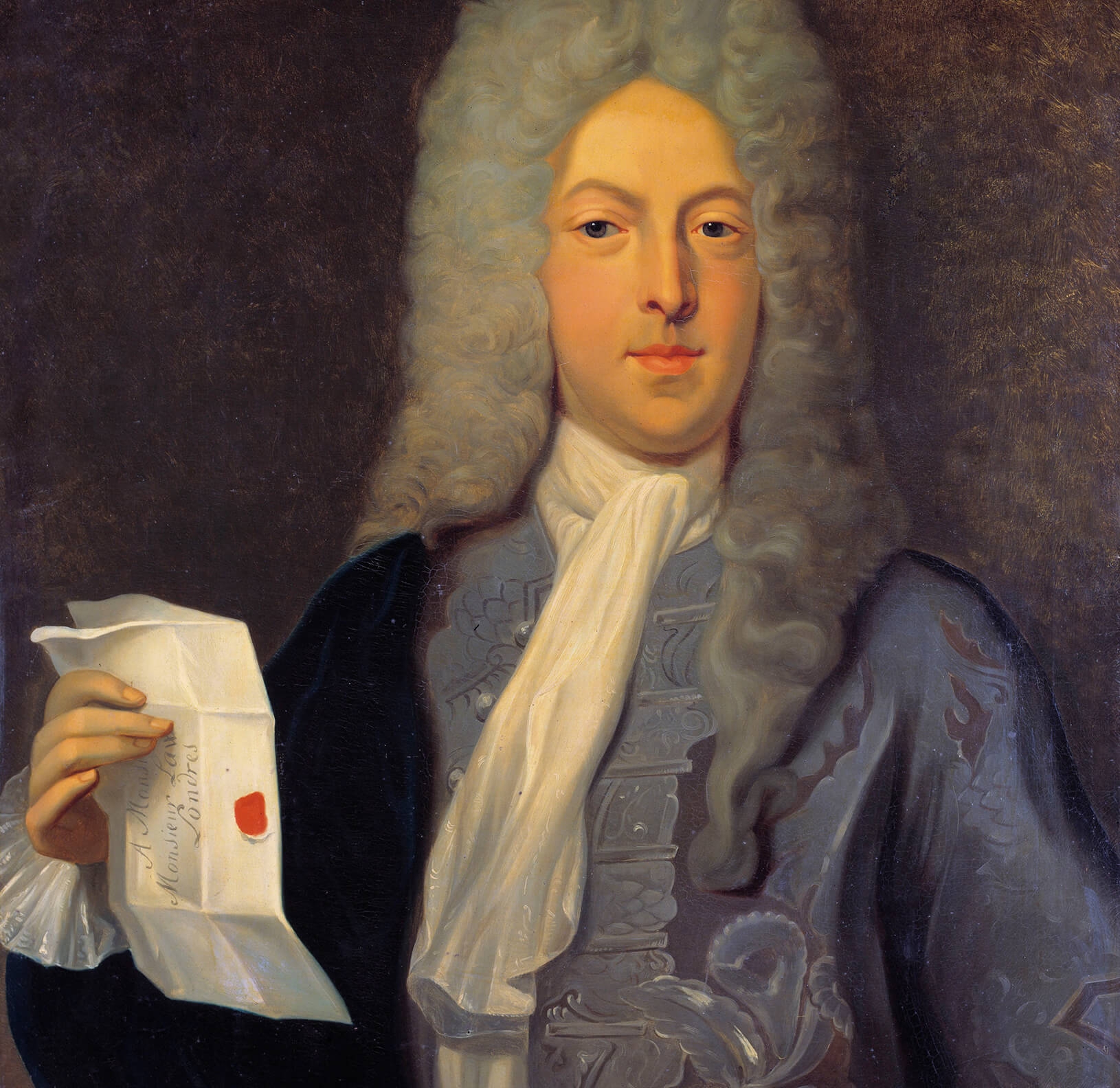

Mississippi Bubble

Leemage/Corbis

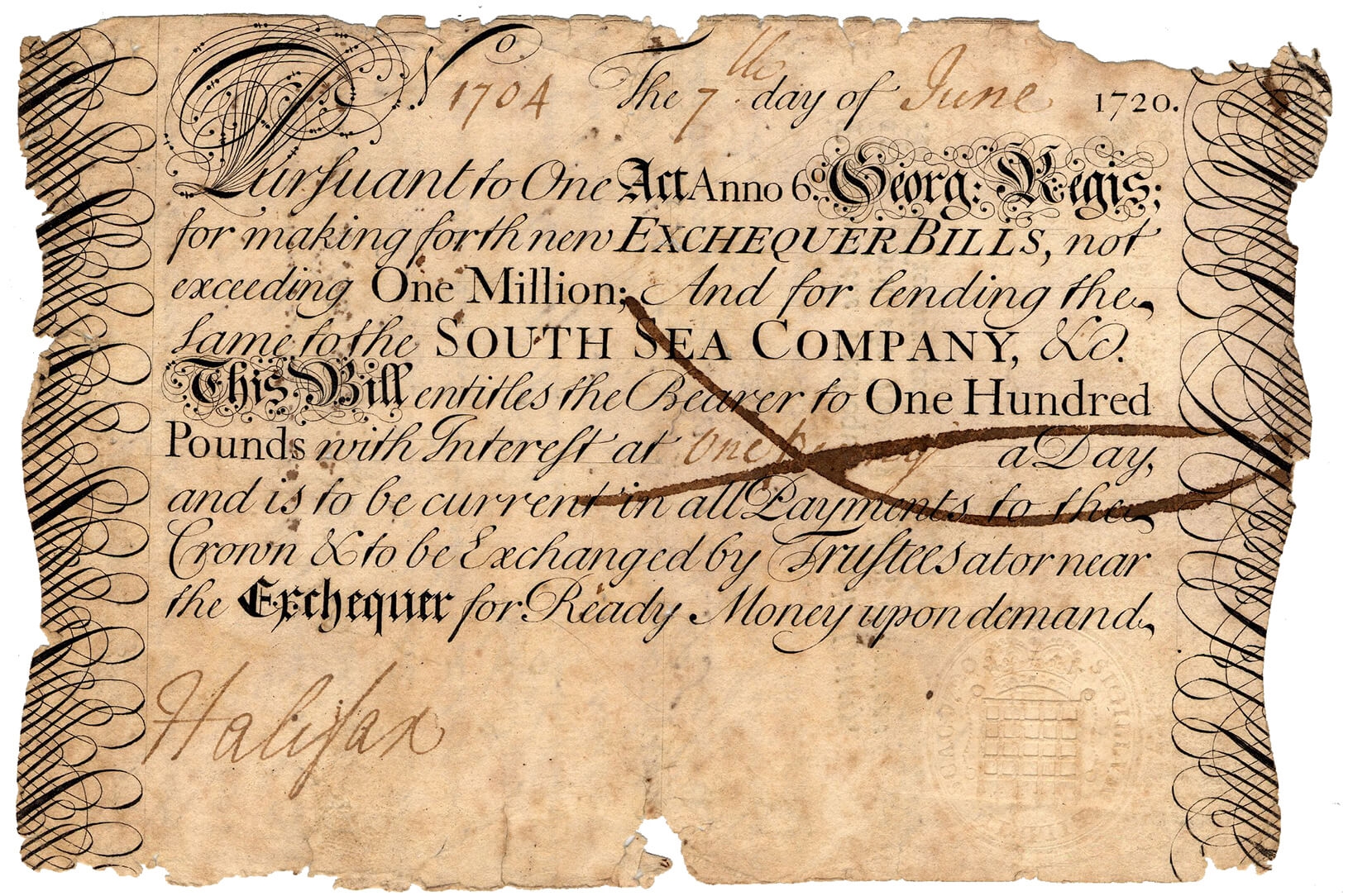

South Sea Bubble

The Trustees of the British Museum

Latin American Debt Crisis

John Carter Brown Library of Brown University

Great Depression

LCDM Universal History Archive/Getty Images

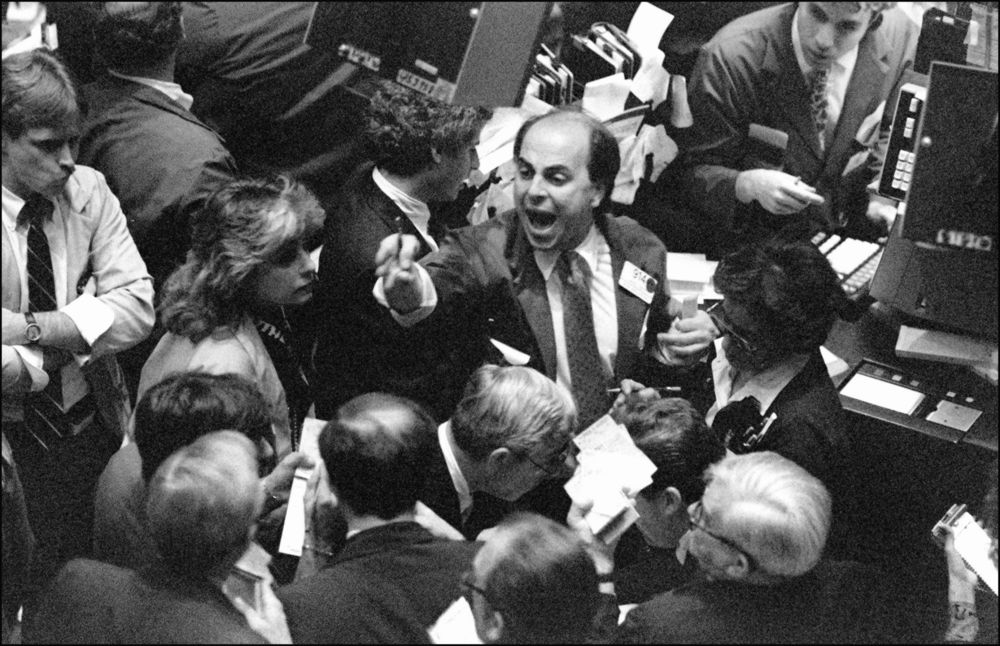

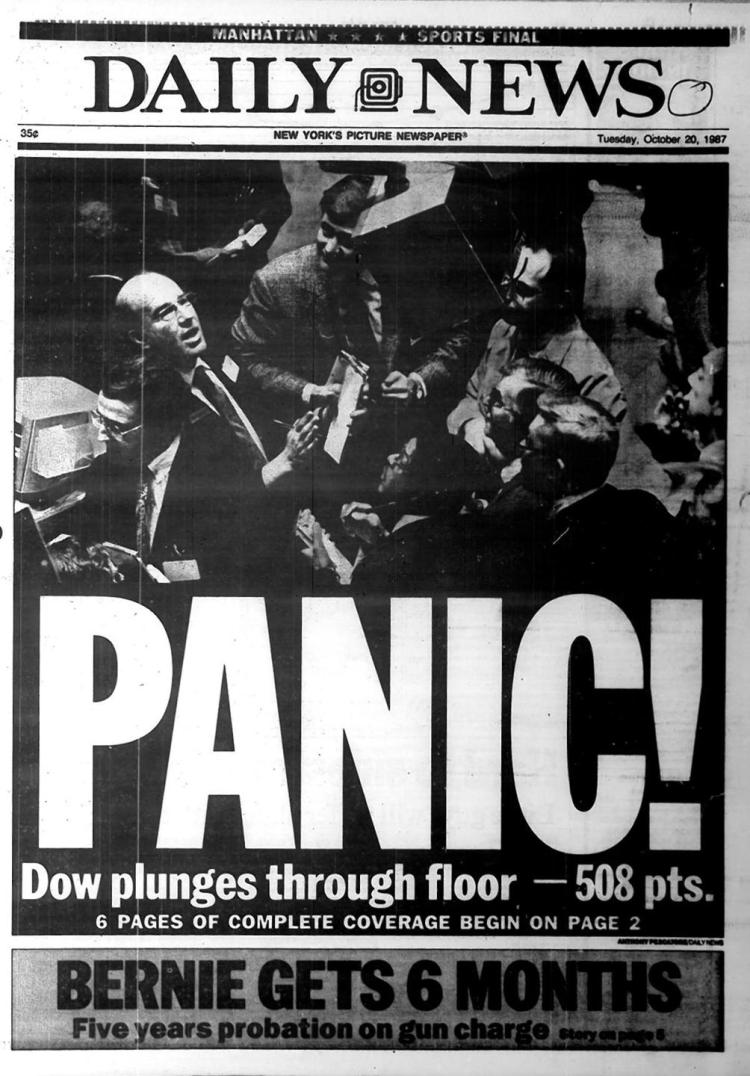

Black Monday

The Great Recession