Author Ben Stein famously said:

“If you didn’t lose a lot of money during the Panic of 2008, you were probably doing something wrong.”

I heard those words and wanted to scream.

His view could not be any farther from the truth. People made fortunes in 2008 with solid moneymaking strategies. The winners were not doing anything wrong, they just happened to have had the vision to prepare for the unexpected, and when the big surprises unfolded they cleaned up.

Investors have been conditioned for decades to believe that they cannot beat the market. They’ve been told to buy index funds and mutual funds, listen to CNBC, and trust the government. I have news for you: That does not work. We have all seen multiple market crashes for decades. But the powers that be keep telling us that the old investing ways are the only way. Deep in our gut we know its not true. Even if we don’t know who the winners are, there are winners in the market, especially in the middle of a crash.

Trend following is a new way of thinking, a new way of making money that is entirely different from what you have been taught. It varies vastly from what you have heard from the brokerage firms, the media, and the government. Bottom line: I go looking for answers where most people cant or don’t know how to go. Digging for trend following trading lessons is my lifeblood.

Plenty of people write books telling you that they know what will happen tomorrow. Do you really want to bet on the words of people who say they know what will happen tomorrow? Doesn’t that just feel like a roll of the dice at the craps tables? Exactly. It is nonsense. However, I do not want you to take my word.

There are men out there that have literally pulled in billions of profit from the market for decades. They are true trading winners who have shared with me their lessons to money- making success. In turn, I am sharing their wisdom with you.

What are the most common threads among these men and their successes? They were all self-starters not born with silver spoons. They did not start with inheritances (but you could have). They figured out how to win, when everyone said they’d lose. They never quit. As diverse as their stories are, they all make up an inspirational foundation you can use to start making a fortune over the course of your lifetime.

Reality of Mutual Funds

Are you willing to admit that buy and hold strategies only works for people who live forever? Mutual funds make a fortune selling the dream:

| Mutual Funds with Largest Fees | 10-Year Period | $21.40 Billion Total Fees Earned |

|---|---|---|

| Fidelity Magellan | 99-08 | $3.70B |

| Fidelity Contrafund | 98-07 | $3.00B |

| American Century Ultra | 99-08 | $2.30B |

| PIMCO Total Return | 99-08 | $3.00B |

| American Funds Inv Co Amer | 98-07 | $1.54B |

| Fidelity Growth & Income | 99-08 | $1.56B |

| American Funds Growth Fnd Amer | 99-08 | $2.10B |

| Fidelity Low-Priced Stock Fund | 99-08 | $1.66B |

| American Funds Europacific | 98-07 | $1.74B |

| Fidelity Dividend Growth | 99-08 | $0.80B |

$21 billion in fees paid to mutual funds for no performance over 10 years.

Why pay billions to mutual funds for no performance?

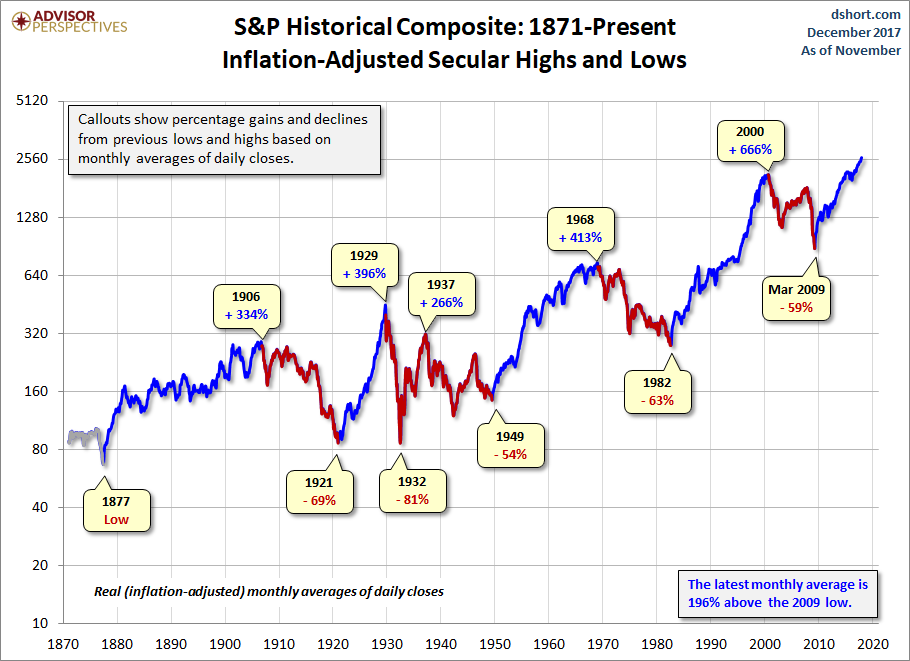

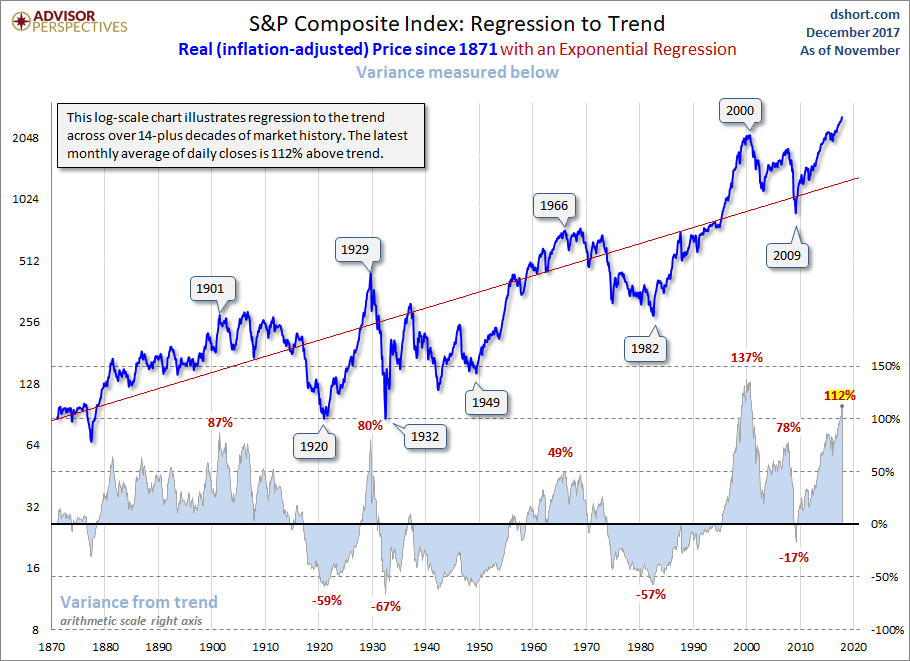

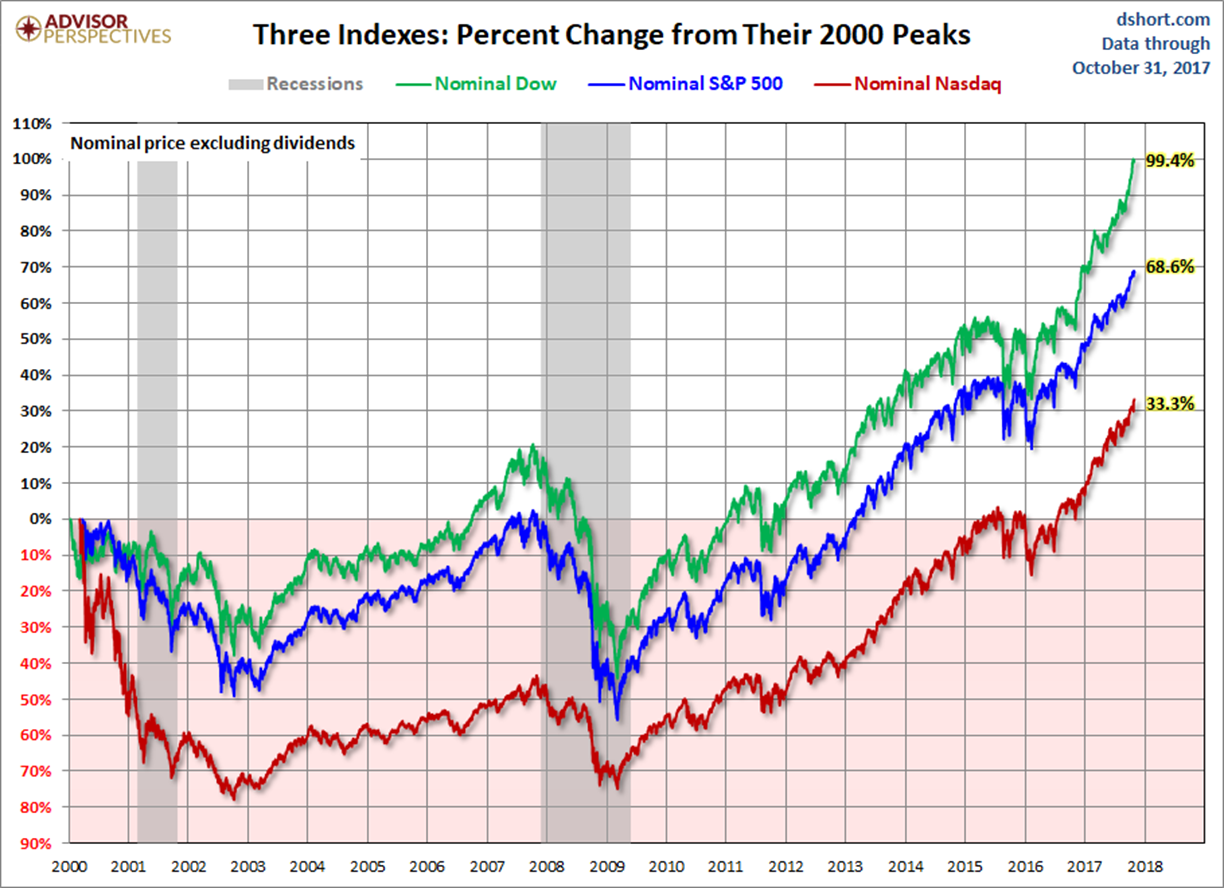

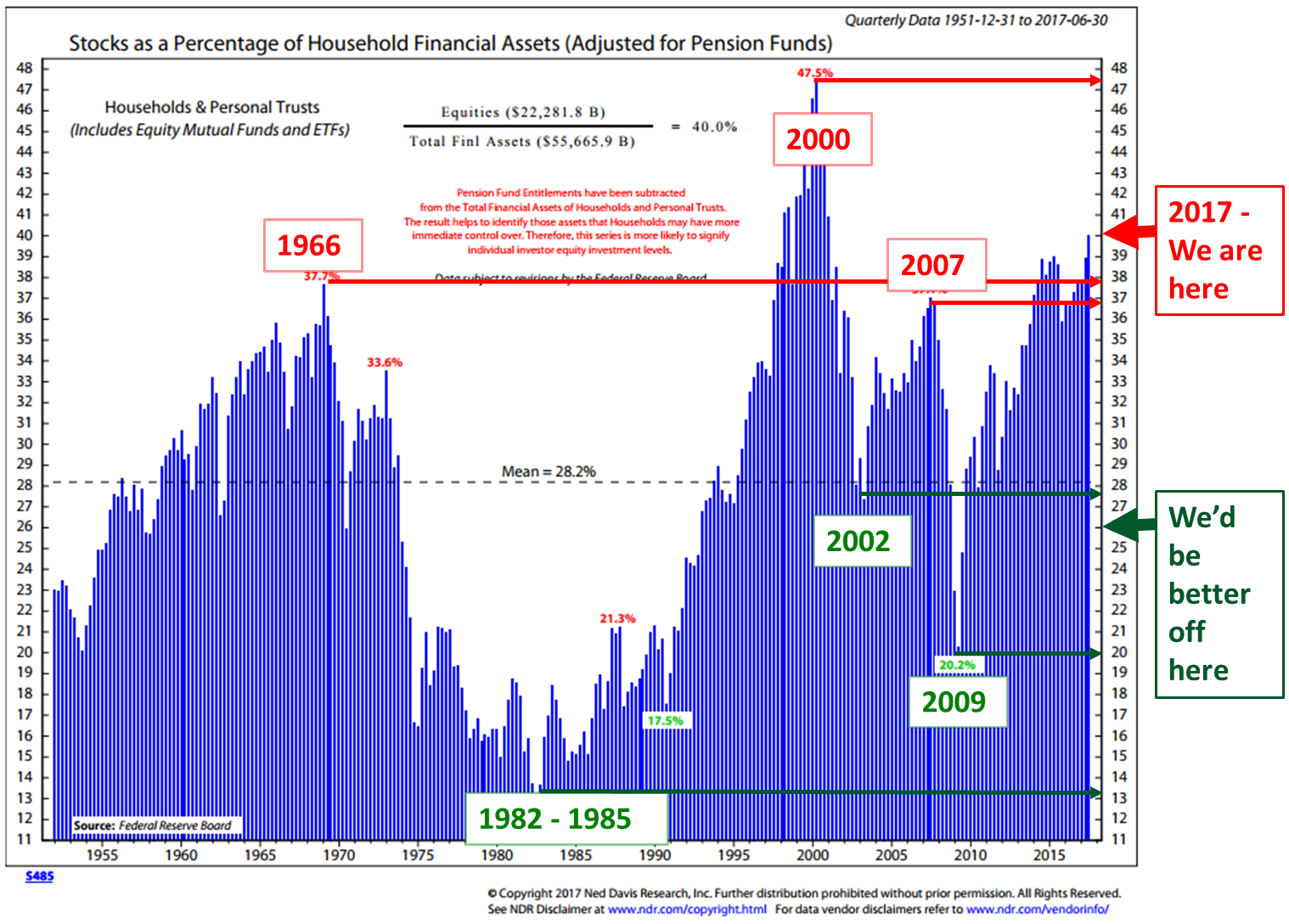

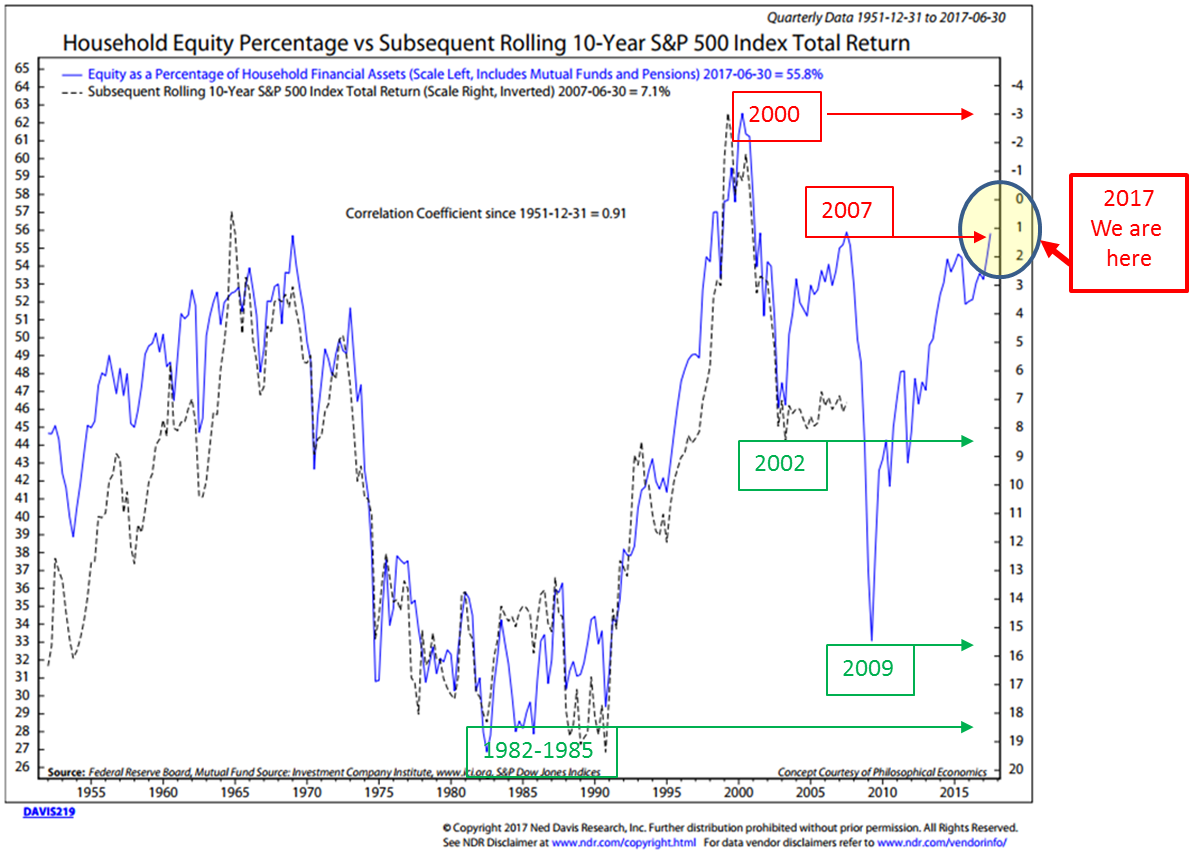

Take it a step further and consider 5 charts:

Is there a way out of that uncertainty?

Yes.

The great traders are not buy and hopers or fundamental traders. The great traders have a plan to deal with the unknown. They know how to handle their emotions. They make money when all hell breaks loose.

The market winners are trend followers who have learned how to ride the bucking bronco up and down for profit.