“Remember, all we have to do is stay in the present moment. Don’t think about the past or the future. Focus on the here and now, and listen to the voice of the market.”

Edward Allen Toppel

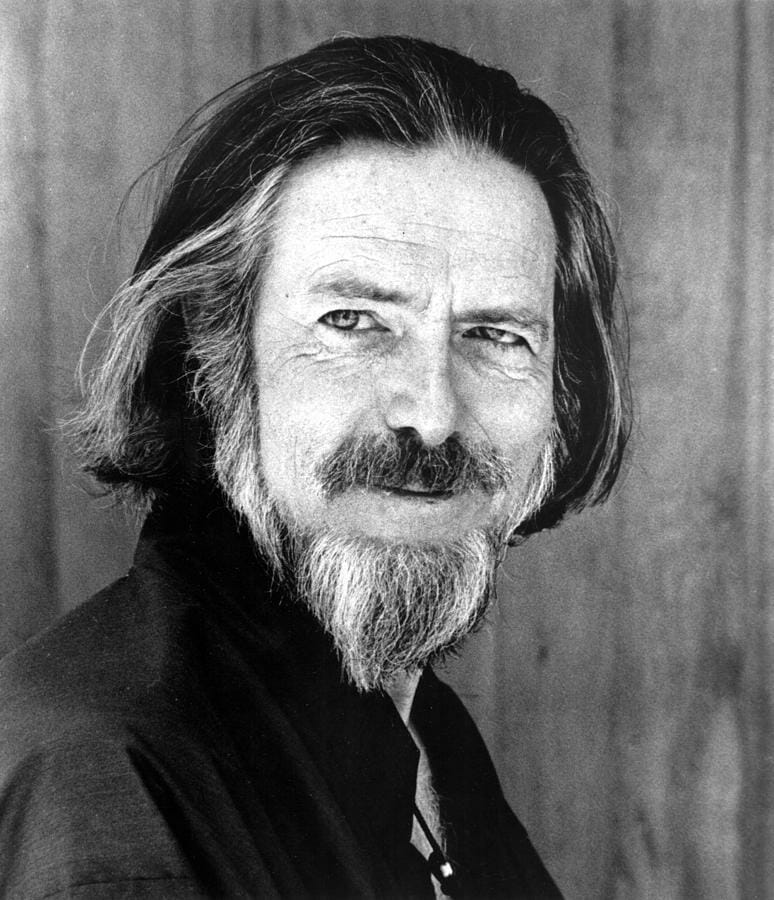

Alan Watts on the Moment of Now

Alan Wilson Watts (6 January 1915 – 16 November 1973) was a British philosopher best known for popularizing Eastern philosophy for a Western audience. He knew the moment of now was all we had:

“[Successful meditation brings about realizations:] That we are no longer this poor little stranger and afraid in a world it never made. But that you are this universe and you are creating it in every moment. Because you see it starts now, it didn’t begin in the past, there was no past. See, if the universe began in the past when that happened it was now; see, but it’s still now — and the universe is still beginning now, and it’s trailing off like the wake of a ship from now, and that wake fades out so does the past. You can look back there to explain things, but the explanation disappears. You’ll never find it there. Things are not explained by the past, they are explained by what happens Now. That creates the past, and it begins here. That’s the birth of responsibility.”

“This is the real secret of life–to be completely engaged with what you are doing in the here and now. And instead of calling it work, realize it is play.”

“We are living in a culture entirely hypnotized by the illusion of time, in which the so-called present moment is felt as nothing but an infintesimal hairline between an all-powerfully causative past and an absorbingly important future. We have no present. Our consciousness is almost completely preoccupied with memory and expectation. We do not realize that there never was, is, nor will be any other experience than present experience. We are therefore out of touch with reality. We confuse the world as talked about, described, and measured with the world which actually is. We are sick with a fascination for the useful tools of names and numbers, of symbols, signs, conceptions and ideas.”

“We must abandon completely the notion of blaming the past for any kind of situation we’re in and reverse our thinking and see that the past always flows back form the present. That now is the creative point of life. So you see its like the idea of forgiving somebody, you change the meaning of the past by doing that. Also watch the flow of music. The melody as its expressed is changed by notes that come later. Just as the meaning of a sentence–you wait till later to find out what the sentence means. The present is always changing the past.”

That mindset is a must for trend following success.

What if Money Was No Object?

The Get Away Car

From Volvo:

“You reach a point in life when you have to choose. Career over passion. Work over play. It’s when surfers turn CEOs. Photographers turn lawyers. Fly-fishers turn doctors. Mountain climbers turn engineers. It’s when you put a piece of yourself on hold. And as time passes, the things you used to love doing, start to fade away. This is a reminder to not forget what you love. All the activities that you once embraced. A message amplified by an original speech by the philosopher Alan Watts, recorded in 1959.”

A commercial? Yes. A very good one whether you own a Volvo or not.

Ed Seykota and the Moment of Now

This clock hangs on Ed Seykota’s wall:

Trend following training and systems.