Michael brings unparalleled expertise and passion to trend following trading, black swans, human behavior and the Holy Grails across Wall Street. Thousands across 4 continents and 25 cities have experienced Michael’s unique message live: Contact for engagements.

Sampling of past global events:

Singapore Trading Festival

Singapore | March 26, 2022

USA | October 2020 (virtual)

India | October 2020 (virtual)

Beijing, China | May 15, 2019

Las Vegas | October 2, 2018

Hong Kong | June 8, 2018

Singapore | March 10, 2018

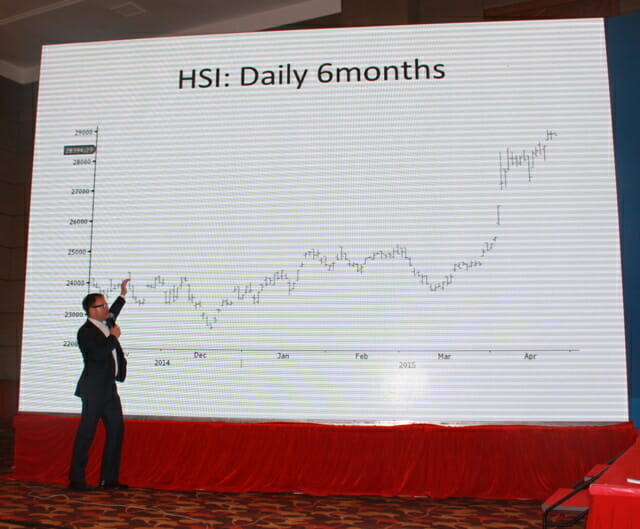

Bogu International Investment Forum

Beijing, China | June 20, 2015

RHB Banking Group

DoubleTree Hilton

Kuala Lumpur, Malaysia | May 6, 2015

Market Technicians Association (Singapore)

Bloomberg LP (Singapore)

Singapore | March 10, 2015

DC Singapore

Conrad Centennial Hilton

Singapore | February 22, 2015

ShareInvestor Pte Ltd.

Suntec Singapore International Convention & Exhibition Centre

Singapore | November 29, 2014

Tropical MBA

Conrad Bangkok

Bangkok, Thailand | October 19, 2014

9th Annual AIMA Japan Hedge Fund Forum

Tokyo Stock Exchange Building

Tokyo, Japan | June 5, 2014

Tropical MBA

Pullman Bangkok Hotel G

Bangkok, Thailand | October 19, 2013

Viet Capital Securities

Sheraton Saigon Hotel & Towers

Ho Chi Minh City, Vietnam | October 2, 2013

China International Fund

Shanghai, China | April 26, 2013

Bank of China Investment Management

Shanghai, China | April 26, 2013

Fullgoal Fund Management

Shanghai, China | April 26, 2013

Bocom Schroders

Shanghai, China | April 26, 2013

International Quantitative Investment Forum

Shanghai World Financial Center

Shanghai, China | April 25, 2013

GF Fund Management

Guangzhou, China | April 24, 2013

Efund Fund Management

Guangzhou, China | April 24, 2013

Invesco Great Wall Fund Management

Shenzhen, China | April 24, 2013

Yinhua Fund

Beijing, China | April 18, 2013

ICBC Credit Suisse

Beijing, China | April 18, 2013

China Asset Management

Beijing, China | April 18, 2013

International Quantitative Investment Forum

The Westin Beijing Financial Street

Beijing, China | April 17, 2013

Michael Covel Key Note Presentation: “Trend Following”.

Public Mutual Bhd

Kuala Lumpur, Malaysia | March 11, 2013

Employees Provident Fund Board

Kuala Lumpur, Malaysia | March 11, 2013

Etiqa Insurance Berhad

Kuala Lumpur, Malaysia | March 11, 2013

GIC Private Limited (Government of Singapore Investment Corporation)

Singapore | March 7, 2013

Nomura Asset Management Singapore Ltd

Singapore | March 7, 2013

Daiwa SB Investments (Singapore) Ltd

Singapore | March 7, 2013

The Chandler Corporation

Singapore | March 7, 2013

Principal Global Investors, LLC

Hong Kong, China | March 5, 2013

Baring Asset Management (Asia) Limited

Hong Kong, China | March 5, 2013

Manulife Asset Management (HK) Ltd

Hong Kong, China | March 5, 2013

CLSA Japan Forum

Tokyo, Japan | February 2013

Michael Covel Key Note Presentation: “Demystifying Trend Following”

Agora Financial Investment Symposium

Vancouver, Canada | July 2012

Michael Covel Presentation: “Trend Following: Performance Proof for the World’s Most Controversial and Successful Black Swan Trading Strategy” (Event Schedule: PDF)

Market Technicians Association Annual Symposium

New York, New York | April 2012

Keynote Speaker:

Stanford

Stanford, California | February 2012

AAII: The American Association of Individual Investors

Houston, Texas | January 2012

CONNEX International: 8th Strategic Investments Forum

La Jolla, California | November 2011

Managed Funds Association

Chicago, Illinois | June 21, 2011

Larry Hite, Ed Seykota & Michael Covel:

CME Group: Traders Expo

Las Vegas, Nevada | November 2010

DerEx: Derivative EXpert

Moscow, Russia (via video uplink) | October 2010

BM&F Bovespa’s 4th International Conference

São Paulo & Campos do Jordão, Brasil | August 2009

The Diversified Trading Institute

Mobile, Alabama | April 2009

TradeTech Europe

Paris, France | April 2008

Stansberry & Associates: Spring Conference

Jekyll Island, Georgia | April 2008

Managed Funds Association: Network

Key Biscayne, Florida | February 2008

TradeTech Asia

Macau, China | November 2007

Commodities Portfolio Management

Dallas, Texas | September 2007

TradeTech Japan

Tokyo, Japan | June 2007

Hedge Funds World Japan

Tokyo, Japan | December 2006

CLSA Investors’ Forum

Hong Kong, China | September 2006

University of Texas Hedge Fund Symposium

Austin, Texas | March 2006

Imperial Hofburg Palace (Superfund)

Vienna, Austria | March 2006

Fonds-Kongress

Vienna, Austria | March 2006

Legg Mason Global Asset Management

Baltimore, Maryland October 2004