Feedback in:

You must use trend following like technical analysis as a tool not a religion. I do believe quantitative easing is good because it drives the stock markets up and as a trader I make my money and pocket when the stocks are going up not with philosophy therefore I believe in Wall Street’s industry and the SEC and the Fed and US government whether good or bad ethically as they are a fact all those so called gurus predict or praise one thing and make money as counterparts as trading is binary buyer or seller by taking the opposite direction/position example Bill Bonner predicted in Money Week mag a few years ago that QE would lead to financial disaster leading to hyperinflation but there is no unemployment right now in the us 5 % there is a growth 3 % / year the highest standards of living in the world big house / cars etc. it is an affluent society but for a tiny minority of lazy couch potato people of course you get my point the truth is none can predict the future and if directors from the fed with a background of PhD in economics from Harvard the most brilliant people cannot they have the best reports from administrations then gurus cant either.

I believe as a taxpayer QE is fair because it drives my stocks up on the market and i want my money back because unemployed workers do not pay taxes and even if QE does not create enough jobs in the real world economy who cares

The worker should learn how to play the game and risk his money on the stock exchange instead of watching football games on TV all day

No pain no gain.

There will always be losers and winners and it is a matter of choice

My feedback:

1. Trend following is a tool. You have some misunderstandings you can correct if you are curious.

2. There are some points in your rant I think might make sense, but other parts are incoherent.

3. Think clearly, please.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

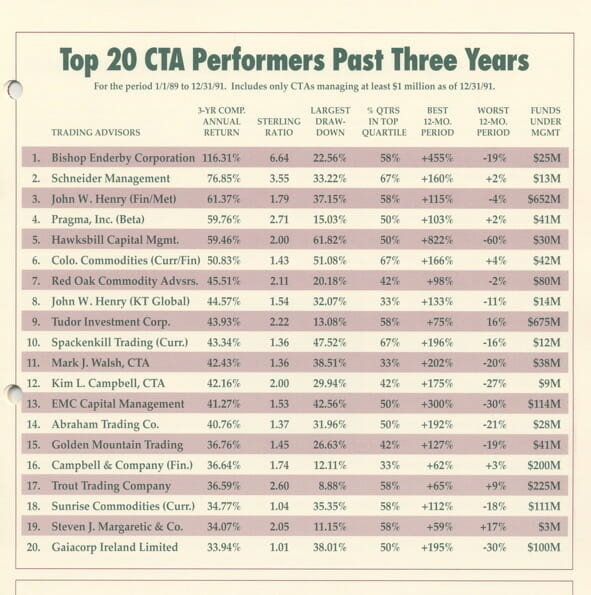

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.