“If there was a strategy that I would want to employ right now, if someone put a gun to my head, I’d say simple trend following strategies. They are not too popular today… They will probably do very well in the next 5 to 10 years.”

–Paul Tudor Jones, Market Wizard

Q: What is trend following?

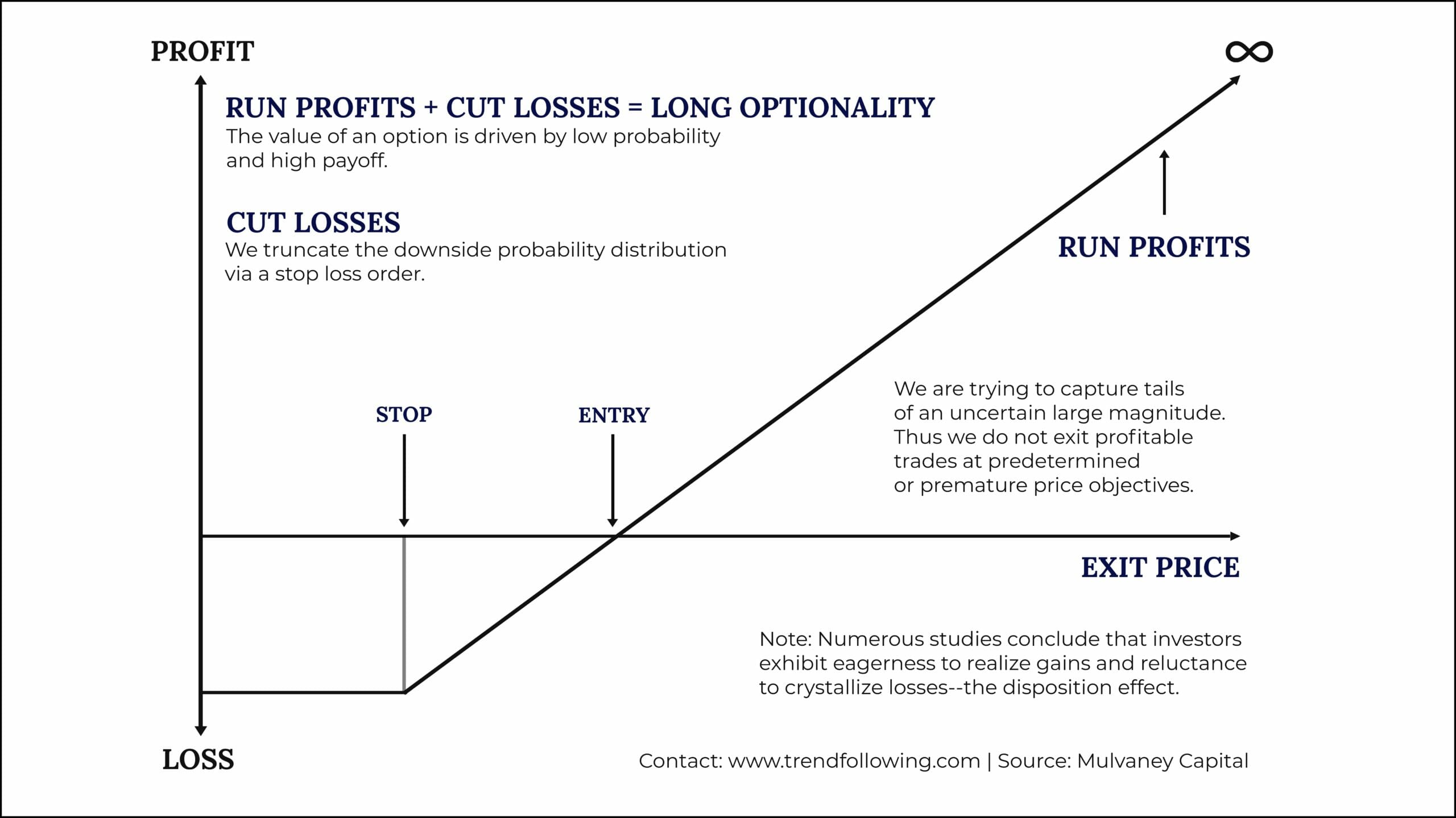

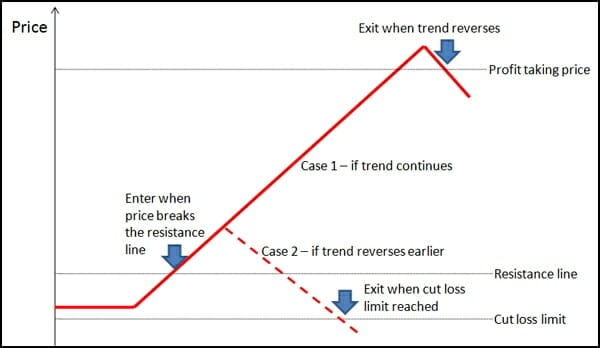

A: Some 200 years ago the economist David Ricardo’s imperative to “cut short your losses” and “let your profits run on” defined trend following. The legendary trader Jesse Livermore stated that the “big money was not in the individual fluctuations but in sizing up the entire market and its trend.” The most basic trend following strategy is going long markets that are going up and shorting those going down.

However, trend following remains a confusing topic for many:

- Trend following is not prediction.

- Trend following is not 5-minute, 15-minute or 1-hour bars.

- Trend following is not day trading.

- Trend following is not RSI or support and resistance.

- Trend following is not candlesticks.

- Trend following is not Wyckoff or Gann.

- Trend following is not point and figure.

- Trend following is not ascending or descending triangles.

- Trend following is not mean reversion.

- Trend following is not a high winning percentage.

- Trend following is not swing trading.

- Trend following is not a 5-day holding period.

- Trend following is not news, fundamentals or discretion.

- Trend following is not one market alone.

Q: Who is Michael’s trend following training for?

A: It is for everyone:

- New traders.

- Professionals.

- College students.

- Investors who want to invest with trend following traders.

- Traders who want to confirm or validate their systems.

- Hedge fund managers, commodity trading advisors and prop traders.

- 401k, IRA and other retirement vehicles.

For anyone who wants a true location independent, trade on a desert island trading profit-making opportunity. For anyone who wants to save time and get there faster.

Q: Is there an on boarding series of steps?

A: The start.

Q: Are the strategies taught enough to help me start profiting?

A: Yes. Everyone needs something when it comes to trend following. They either need a lot, a little, or reinforcement. Michael helps all levels.

Q: What are performance examples?

A: For more than seven decades trend following traders have produced massive profits. Also see Michael’s books. Also see historical charts.

Concept 1:

Concept 2:

Q: Which markets are for trend following?

A: Stocks. Bonds. Interest Rates. Currencies. FX. Forex. Metals. Energies. Agriculturals. Softs. Meats. Futures. Commodities. ETFs. LEAPS Options. Mutual Funds. Cryptocurrencies. Read.

Q: Trend following training appears not inexpensive.

A: Paying for trading education is far less expensive than losing a fortune with no trading plan. Consider it an investment in your future wealth.

Q: Guarantee?

A: Yes.

Q: Is this fancy software and complicated algos?

A: No. There is so much computing power available, so much data available, but the trend following rules can be explained on the back of a napkin. You will learn rules you can apply for potential profit ASAP. Can software help automate trend following strategies? Sure, but don’t let automation fool you. It starts with you and your rules. For example, one of the most accomplished trend following traders of the last 30 years, a man who has made billions, still tracks and automates with EXCEL. Nothing fancy. Full view on software.

Q: Do your systems/courses come with recommendations?

A: You will know all trades to take for all markets at all times. You won’t need ongoing ‘recommendations’ as you will have all Michael knows from the start. Michael’s trend following courses and systems give you the rules for your ongoing trade signals (what some might call recommendations).

Q: Is this black box system trading?

A: No. This is not black box trading. All rules taught are fully disclosed.

Q: Your background?

A: Read.

Q: How did you learn trend following?

A: Read.

Q: The origins of trend following?

A: Read.

Q: When does trend following work?

A: When markets trend–the short answer. You aim to extract profits from up, down and black swan markets (rare or surprise events), resulting in above-average returns. All course systems can be applied in a 100% systematic manner. Think of this like a machine:

Q: How detailed is your training?

A: Michael teaches an overall trend following education with exact trend following systems that can be applied immediately to your account. That means you will have: Exact rules for selecting your tracking portfolio. Exact rules for entering your trades at the right time. Exact rules for exiting your trades with a loss. Exact rules for exiting your trades with a profit. Exact rules for how much money to bet on each trade.

Q: Why sell a system that works?

A: Michael is a capitalist. He enjoys teaching.

Q: What is the difference between your books and courses?

A: The books are great resources filled with thousands of details, and they have helped many traders make money, but Michael’s courses are different. Questions come up. People need help. Personal instruction gives insights. Many proprietary trading systems are included (not in the books).

Q: This is only for America?

A: Michael’s clients are in 70+ countries trading from Europe to Asia to the Middle East to South America to North America.

Q: This is for the individual investor too?

A: Many of Michael’s clients are individuals trading their own account. Many with no experience. Some have experience, but the wrong kind. Whether 21 and in college, age 30 working a job, or age 75 in retirement, you can learn trend following trading.

Q: You have market professionals as clients?

A: Too many to count. Michael’s systems and training are used by experienced traders worldwide. Hedge fund managers to CTAs to CFAs to CMTs brokers to financial advisers on every continent.

Q: How were Michael’s systems and training assembled?

A: The great traders, along with their trading rules, are not easily accessed. It’s a closed club. However, Michael Covel has dedicated his career to assembling the best rules and lessons from those who know. He has spent the last 20 years on the inside learning from the greatest traders of our time. View mentors.

Q: Can your courses and systems be applied to shorter time frames like hourly or 4-hour charts? Does day trading work in conjunction with trend following?

A: No. Day trading is fool’s gold. Michael’s systems and courses will be worth millions to you over a lifetime.

Q: Talk about the learning process for your clients?

A: Read.

Q: Starting capital is needed?

A: Read.

Q: What about retirement accounts?

A: You can trade trend following methods in retirement accounts, i.e., 401ks, IRAs, Keoghs, Seps, etc.

Q: Trend following works on stocks?

A: Yes. Trend following is not market specific. For example, today trend following traders can trade ETFs and get exposure to stock and commodities markets without having to trade futures. You will learn the best option for your situation.

Q: Is this risky?

A: Life is risky. You can get hit crossing the street. However, if you have a concrete plan, risk is managed.

Q: Do university classes teach trend following?

A: No. Many of the greatest traders had little to no experience trend trading before starting. Trend following legend John W. Henry (owner of Boston Red Sox and Liverpool Football) did not have a college degree.

Q: Speak to behavioral biases.

A: Trend following handles the biases:

Q: How much math is involved?

A: The basics: add, subtract, multiply, divide.

Q: Do trend followers watch screens during market hours?

A: No. For example, some only trade once a week using weekly bars. Most use daily bars. There is 0 need to watch the screen during market hours.

Q: How much time is required to trade as a trend following trader?

A: You can spend a minute or two per market each day. For example, you check prices in the evening, then with one trade in the morning, you place or change any orders in accordance with rules. Michael’s trend following trading systems use daily data to determine buy and sell signals. Orders can be placed before the market opens and do not need hourly monitoring. Most top traders manage their trades in 10 to 30 minutes per day. Trend follower Richard Donchian: “If you trade on a definite trend-following loss limiting-method, you can trade without taking a great deal of time from your regular business day. Since action is taken only when certain evidence is registered, you can spend a minute or two per [market] in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning place or change any orders in accord with what is indicated. [Furthermore] a definite method, which at all times includes precise criteria for closing out one’s losing trades promptly, avoids…emotionally unnerving indecision.”

Q: Can trend following strategies be automated?

A: Read.

Q: Why is money management needed?

A: Money management, or position sizing, is a mission critical component of trend following trading success.

Q: Are markets different now? Have they changed?

A: No. Markets are always the same because they always change. Trend following trading adapts to constant change. That’s the way to look at it. If someone says markets have changed, reach your wallet. You are about to be picked. Alan Watts the philosopher makes the case for how trend following responds to constant change: “If, when swimming, you are caught in a strong current, it is fatal to resist. You must swim with it and gradually edge to the side. One who falls from a height with stiff limbs will break them, but if he relaxes like a cat he will fall safely. A building without give in its structure will easily collapse in a storm or earthquake.”

Q: Is 24-hour news needed?

A: You don’t need real-time data or news. You don’t need news at all.

Q: Once Michael’s training is completed is a broker or financial adviser needed for advice?

A: No.

Q: What do you think of chart reading, candles, Gann, trend lines, Fibonacci and Elliott Wave?

A: Bullshit. Junk science. Waste of time.

Q: Monthly expenses needed?

A: You need money to trade and daily price data (about $20-50/month).

Q: Do you explain the markets to trade and why?

A: Diversification across markets is part of the process. Trend following exposure to many markets allows profits to cover losses. Big moves, and the profits from those, offset small losses across a diversified portfolio. You can trade those types of markets via ETFs, LEAPs and or futures.

Q: Are chart techniques used to pick entry levels, exit levels and where to place stop levels? Do you teach a one-size-fits-all method of level picking or do you tailor it to the individual?

A: No chart techniques are used, but you will know exactly your entry, exit and where to place stops. The rules taught can be tailored.

Q: Speak to non-USA markets.

A: Trend following is for all markets, all countries. Michael’s clients are in 70 plus countries.

Q: Do your rules help to profit during crashes and tail events?

A: Yes. Making money from black swans, surprises, tail events and crashes is core to trend following success.

Q: Is it possible to compete against the big funds?

A: Yes, but this is not about competition. The big funds don’t stop little guys from trading. The idea that big traders block small traders is nonsense. Think about this: smaller traders can trade markets larger traders can’t.

Q: Are too many trading as trend following traders?

A: The amount of money in trend following methods is tiny by comparison to the money stuck in buy and hold mutual funds. The opportunity for trend following success is massive.

Q: What are your criteria to identify a trend?

A: In trend following you don’t do that. In trend following you take entry signals and have exit signals. Anyone saying they can spot or predict trends in real time is a bullshitter.

Q: Is trend following a full-time job? I’d like to know if it can be done part time?

A: You can be part-time. This is not day trading. You can trade using daily or weekly closing prices. No other strategy allows this.

Q: The podcasts are very educational. I have only listened to about 80 of them and while I enjoy them enormously, they mostly dive into the human nature. Do I need to buy Michael’s entire course to be able to understand trend trading?

A: Michael’s gives away a ton of free resources, but if you want to go fast and take advantage of Michael’s best work his courses are the quickest bet.

Q: What makes your system and course different?

A: Michael’s training is not a commodity. You can only receive it here. Review Michael’s books and podcast.

Q: You have a film?

A: Yes. Watch here.

More frequently asked questions: here, here, here.

Top 10 Reasons

Top 10 reasons why new and professional traders take Michael’s training for the chance at above average performance:

1. Brand new trader and or investor. No experience.

2. College student. No experience.

3. Need ready to use trend following systems.

4. Need new trend following systems.

5. Need a comprehensive trend following education

6. Need confirmation for their current strategy.

7. Need support. Have questions.

8. Need overwhelming research to validate trend following concepts.

9. Missing something in their current approach or technique.

10. Have been seduced by bogus Wall Street approaches and techniques. Need a fresh start right now.

Michael’s training and systems are for all situations.

Trend Following Theory

Trading: Traders are different. They have a defined strategy to profit in all climates. Trend following traders do not care what market they buy or sell as long as they make money.

Absolute Returns: Trend Following™ has above-average performance over the last 7 decades. The potential to compound wealth is huge.

Up and Down Trends: Trend Following™ makes money in up or down markets, bull or bear.

Tail Risk: Trend following strategy performs above average when market bubbles pop, when the Black Swan arrives. For example, trend following made huge money during the Stock Crash (1973–74), Black Monday (1987), Barings Bank (1995), LTCM & Asian Crisis (1998), Stock Crash (2000-02), 9/11 (2001), Great Recession (2008-09), Oil Market (2014-16), Brexit (2016), Covid-19 (March, 2020) and all of 2022. Review big events.

Portfolio Diversification: Trend Following™ returns are uncorrelated to traditional passive investments.

Works on All Markets: Trend Following™ doesn’t trade one market alone. Bitcoin too.

Inefficient Markets: Trend Following™ destroys against the efficient markets hypothesis (EMH).

Research: Trend Following™ has profited for centuries. Review third party research: PDF 1 and PDF 2.

Nurture Beats Nature: Winning traders don’t have a special gene, divine gift, innate talent, inside knowledge or huge starting capital. They have a system.

Everything Flows: Trend followers react to market movements and follow along without a story about why.

Statistical Thinking Is Paramount: During a Monday Night Football game, Ron Jaworski nailed it: “Play calling is about probability not certainty.”

Market Bubbles: The mythological 100-year flood happens all the time. Since 1929 there have been 18 market crashes always rooted in irrational exuberance. Read more.

Fundamentals Are Religion: To paraphrase a great trader: “The illusion has been created that there is an explanation for every market move with the primary task to find that explanation.” Trend Following™ does not need news, fundamentals or chart patterns.

The Market Is Never Wrong: People hang on and pray the market will come back if it doesn’t go in their favor. Don’t do that. The market is never wrong.

You Have to Bet to Win: Take big risks if you want big rewards. If you want an average reward, take an average risk. No balls, no babies. However, as Larry Hite said, “Don’t bet your deli to win a pickle.”

Process Beats Outcome: Do you want to be right or rich? You have no control over the results; you have control over your action. You can only control how much you lose.

Think Like Kenny Rogers: If you must play decide upon three things at the start: the rules of the game, the stakes and quitting time. You’ve got to know when to hold ’em. Know when to fold ’em. Know when to walk away. Know when to run.

Behavioral Biases: The lessons of the greatest trading psychology pros are part of Trend Following. See the podcast.

Learn to Love Losses: P.T. Barnum said, “This way to the egress!” If famed trader Amos Hostetter lost 25 percent he’d exit: “Never mind the cheese. Let me out of the trap.”

Technology Is No Mistress: Pablo Picasso said, “Computers are useless. They can only give you answers.” Start by answering your daily market questions in advance. Automating answers is the easy part.

Zero Sum Battles Are Life: If you are going to win, someone else will lose. Does survival of the fittest make you uneasy? Stay out of the zero sum game (PDF).

Hero Worship Kills Accounts: When TV pundits say it’s time to buy Google or dump Apple, millions follow random advice blindly. Don’t drink that Kool-Aid.

Buy and Hold (Hope): Buy and hold works for investors who live forever. It also works for those who believe in magical thinking and pixie dust. Mutual funds and cosmetics: They both sell hope.

No Balance Sheets: It does not matter if you’re trading stocks or soybeans: “Trading is trading, and the name of the game is to make money, not get an A in ‘How to Read a Balance Sheet?'”

No Tops and Bottoms: Trend following aims to capture the middle, or meat, of a market trend, up or down, for profit. You will never get in at the absolute bottom or get out at the absolute top.

Have Markets Changed? Not only have markets changed, they continue to change: “If you have a valid market philosophy, learning to accept that change and flow with it is your greatest asset. No matter how ridiculous market moves appear at the beginning, and no matter how extended or irrational they seem at the end, following trends is the rational choice in a chaotic, changing world.” That’s how the owner of the Red Sox made his trend following fortune. More.

True Reality: “If you want to make money in any market, you need to mirror what the market is doing. Other things being equal, the longer you stay right with the market, the more money you will make. The longer you stay wrong with the market, the more money you will lose.”

Price Makes Markets the Same: “You do not need to know anything about bonds. You do not need to understand different currencies. They are just numbers. Corn is a little different than bonds, but not different enough to trade them differently. Some people have a different system for each market. That is absurd. You are trading mob psychology. You are not trading corn, soybeans, or the S&P. You are merely trading numbers.”

No Discretion: “You cannot test or simulate how you were feeling when you got out of bed 15 years ago when you’re looking at historical simulations. If you’re going to trade using a system, you must slavishly use the system and avoid discretionary overrides. You do whatever the hell the system says no matter how smart or dumb you might think it is at that moment.”

Proper Betting: If you have $100,000 and you want to trade Gold, well, how much will you trade on your first trade? Will you trade all $100,000? What if you’re wrong? What if you’re wrong in a big way and lose your $100,000 on one bet? Not smart.

Prenuptial Agreement: The paramount factor when the market goes against you: “I’m out!” You need a prenuptial agreement with the market. The time to think about when you exit is before you ever get in.

Home Run Trades: A trend following baseball coach would approach it like the former manager of the Baltimore Orioles: “Earl Weaver designed his offenses to maximize the chance of a three-run homer. Weaver did not bunt or want guys who slapped singles. He wanted guys who hit big home runs.”

Clarity of purpose is investment success.

Eliminating noise with precise trend rules that adjust to any situation, climate or cycle is the goal. Going on an information diet is mandatory.

Systematic and consistent processes beat fundamental guesses every time. Your investing will be like this video.

Investment stress is a killer. Multitasking with screens, news and nonstop predictions will fry your brain–guaranteed. Michael will have you focus on the right task, not every last task. Consider this infographic.

The religious rituals of the government, media and finance will bleed you dry: “CNBC really could not care less about the actual content of what is being said. The purpose of CNBC’s game is…to sell advertisements. Nothing evil or wrong about this. It’s what for-profit media companies do. But the content they are producing…needs to be understood as such.”

Deliberate practice is mandatory for excellence. Listen to a podcast with the world’s foremost expert on peak performance.

Final Words of Wisdom

Consider a non-trading example that explains the truth of process v. outcome: “Instead of talking about wins and championships, Alabama Head Football Coach Nick Saban speaks about the process. The process is Saban’s term for concentrating on the steps to success rather than worrying about the end result. Instead of thinking about the scoreboard, think about dominating the man on the opposite side of the line of scrimmage. Instead of thinking about a conference title, think about finishing a ninth rep in the weight room. Since Saban has won 5 of the past 13 national titles, the phrase has morphed into the mission statement for Saban’s program-building philosophy. Today everyone is trying to replicate his philosophy and results. Call it the Sabanization of college football.”

Famed contrarian investor Howard Marks speaks to that quest for greatness: “The real question is whether you dare to do the things that are necessary in order to be great. Are you willing to be different, and are you willing to be wrong? In order to have a chance at great results, you have to be open to being both.”

The Trend Following™ race for you is on whether you run or pretend there is no race. One of Michael’s favorite sayings paints the picture: “Every morning in Africa, a gazelle wakes up. It knows it must run faster than the fastest lion or it will be killed. Every morning a lion wakes up. It knows it must outrun the slowest gazelle or it will starve to death. It doesn’t matter whether you are a lion or a gazelle: when the sun comes up, you’d better be running.”

Ready to start running? Go here.

Questions? Email.

Disclaimers

Trend Following™ can not promise you will earn the returns of traders, charts or examples (real or hypothetical) stated. All past performance is not necessarily an indication of future results. Data presented is for educational purposes. Trend Following™ products are provided for informational purposes only and should not be construed as personalized investment advice. All data on this site is direct from the CFTC, SEC, Yahoo Finance, Google and disclosure documents by managers mentioned herein. Trend Following™ assumes all data to be accurate, but assumes no responsibility for errors, omissions or clerical errors made by sources.

Our testimonials are the words of real clients received in real correspondence that have not been paid for their testimonials. Testimonials are sometimes printed under aliases to protect privacy, and edited for length. Claims have not been independently verified or audited for accuracy. We do not know how much money was risked, what portion of their total portfolio was allocated, or their exact positions. We do not claim that the results experienced by such clients are typical and you will likely have different results.

Trend Following™ is not registered as a securities broker-dealer or an investment adviser. This information is not designed to be used as an invitation for investment with any adviser profiled. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Further, Trend Following™ cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing.

Additionally, Trend Following™ in no way warrants the solvency, financial condition, or investment advisability of any security or instrument. In addition, Trend Following™ accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as a basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.