Six years into this website I decided it was time for a book or maybe the book decided it was time for me. Larry Harris, the finance chair at the University of Southern California, randomly e-mailed me. He wanted me to review his new book because I was driving more interest in his whitepaper, The Winners and Losers of the Zero-Sum Game (PDF), than anyone else. Without skipping a beat I said sure to a review of his book, but asked for an introduction to his publisher, since I was writing a book, too. He obliged and connected me even though my book at that moment was conceptual.

That email changed my life.

Why?

The zero-sum nature of many markets is arguably the most important concept in markets.

Larry Harris notes:

“Trading is a zero-sum game when gains and losses are measured relative to the market average. In a zero-sum game, someone can win only if somebody else loses.”

Harris told me he was amazed at how many people came from my websites to download his white paper on zero-sum trading–the topic left out of most strategy discussions. It’s one winner and one loser. Harris examines the factors that determine who wins and who loses in market transactions. He does this by categorizing traders by type and then evaluating speculative trading styles to determine whether the styles lead to profits or losses:

“Winning traders can only profit to the extent that other traders are willing to lose. Traders are willing to lose when they obtain external benefits from trading. The most important external benefits are expected returns from holding risky securities that represent deferred consumption. Hedging and gambling provide other external benefits. Markets would not exist without utilitarian traders. Their trading losses fund the winning traders who make prices efficient and provide liquidity.”

There are those who absolutely do not accept that there must be a loser for them to be a winner. They cannot live with the fact everyone can’t be a winner. Although they want to win, many do not want to live with the guilt by their winning, someone else has to lose. This is a poorly thought out yet all too common view of the losing trader’s mindset. Harris is clear on what separates winners from losers:

“On any given transaction, the chances of winning or losing may be near even. In the long run, however, winners profit from trading because they have some persistent advantages that allow them to win slightly more often or occasionally much bigger than losers win…To trade profitably in the long run, you must know your edge, you must know when it exists, and you must focus your trading to exploit it when you can. If you have no edge, you should not trade for profit. If you know you have no edge, but you must trade for other reasons, you should organize your trading to minimize your losses to those who do have an edge. Recognizing your edge is a prerequisite to predicting whether trading will be pro table.”

Nobel Prize winner and co-founder of famed trend following incubator Commodities Corporation Paul Samuelson adds:

“For every trader betting on higher prices, another is betting on lower prices. These trades are matched. In the stock market, all investors (buyers and sellers) can profit in a rising market, and all can lose in a falling market. In futures markets, one trader’s gain is another’s loss.”

Market voice Dennis Gartman adds to the perspective:

“In the world of futures speculation, for every long there is an equal and opposite short. That is, unlike the world of equity trading where there needn’t be equal numbers of longs versus shorts, in the world of futures dealing there is. Money is neither made, nor lost, in futures; it is simply moved from one pocket to the next as margins are swapped at the close of trading each day. Thus, every time there is a buyer betting that prices shall rise in the future, there is an equal seller taking the very opposite bet, betting that prices will fall.”

The players in markets who lose over the long run are generally commercial hedgers. The reason for this is that hedgers use the markets for risk insurance, and insurance premiums always cost money. Of course, other speculators with bad strategy can provide winners with their gains too. As counterintuitive as it seems, if you buy higher highs and sell short lower lows, and you use solid money management to manage and exit trades, you can find a mathematical edge in the long run. This keeps you opposite hedgers as much as possible. It is not rocket science by any means, but it holds up over time very robustly (source: Dave Druz interview).

These observations will save your skin if you’re willing to accept the truth, but as you know, many are either ignorant to zero-sum trading thinking, choose to ignore it, or refuse to believe it–condemned to exist inside biases.

The market is brutal. Forget trying to be loved. Need a friend? Get a dog.

Zero-Sum Market Event Examples

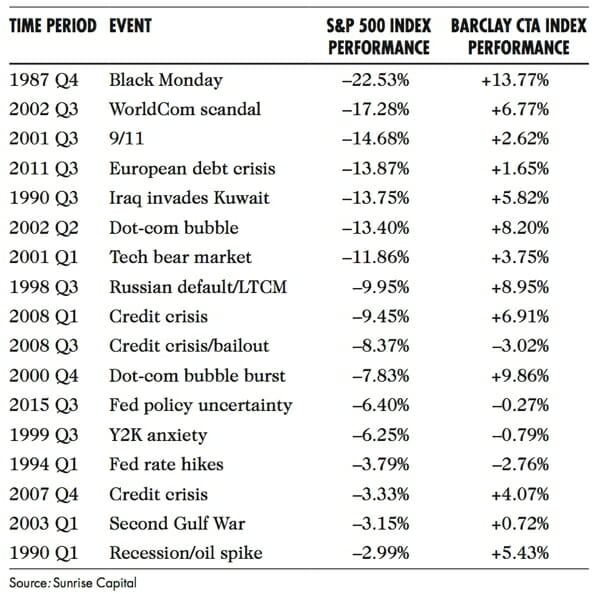

When are times you can see the zero-sum market world in action with trend followers as winners?

Bubbles, Big Events, Crashes, and Panics

You will find very detailed big event examples in chapter 4 of my book Trend Following, 5th Edition: How to Make a Fortune in Bull, Bear and Black Swan Markets. For example:

Event 1: Great Recession 2007-2009

Event 2: Dot-Com Bubble

Event 3: Long-Term Capital Management (LTCM)

Event 4: Asian Contagion

Event 5: Barings Bank

Event 6: Metallgesellschaft

Event 7: Black Monday 1987

Event 8: Stock Crash 1973-1974

Trend followers killed it every time during those events, but it did not stop there. Events from the past like Amaranth? Trend followers win when the proverbial shit hits the fan. Kieron Nutbrown, former head of global macro fixed income at First State Investments, has assembled a massive list of historical zero sum events. You can see that and much more here.

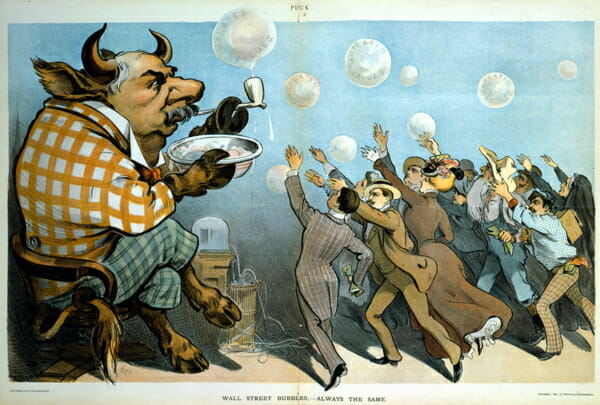

Won’t the future be different? Forget it. Human nature is predictable. The Bernie Madoff mindset never goes away. Read Thinking, Fast and Slow and consider a cartoon from 22 May 1901:

Consider the historical narrative:

You can blow that up here: (PDF). Look, this is not about being bearish, this is about riding trends up and down. If you keep that mindset you are on the way to market success.

Products

Obtain proprietary trend following systems with full support.

That’s the way to battle in a zero-sum world.

Disclaimers

Trend Following™ can not promise you will earn the returns of traders, charts or examples (real or hypothetical) stated. All past performance is not necessarily an indication of future results. Data presented is for educational purposes. Our products are also provided for informational purposes only and should not be construed as personalized investment advice. All data on this site is direct from the CFTC, SEC, Yahoo Finance, Google and disclosure documents by managers mentioned herein. Trend Following™ assumes all data to be accurate, but assumes no responsibility for errors, omissions or clerical errors made by sources.

Our testimonials are the words of real clients received in real correspondence that have not been paid for their testimonials. Testimonials are sometimes printed under aliases to protect privacy, and edited for length. Claims have not been independently verified or audited for accuracy. We do not know how much money was risked, what portion of their total portfolio was allocated, or their exact positions. We do not claim that the results experienced by such clients are typical and you will likely have different results.

Trend Following™ is not registered as a securities broker-dealer or an investment adviser. This information is not designed to be used as an invitation for investment with any adviser profiled. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Further, Trend Following™ cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing.

Additionally, Trend Following™ in no way warrants the solvency, financial condition, or investment advisability of any security or instrument. In addition, Trend Following™ accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as a basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.