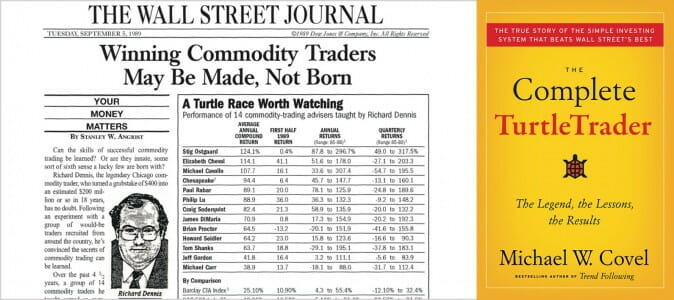

If you want to know the true Turtle trading story…

If you want to separate fact from fiction… greatness from not…

If you want to know how this timeless nurture trumping nature story can work for you today…

The last word on the TurtleTrader story is in my book and on my podcast with Jerry Parker (plus other Turtles) and on my TurtleTrader website.

Dive in.

Praise

“Most beat-the-market books aren’t worth my shelf space. This one is.”

James Pressley

Bloomberg

“If you want to beat the market, you have to do something different from what everyone else is doing, and you have to be right. In this fascinating and instructive book, Michael Covel tells how a group of novice traders used a system that generated trades that were both different and right, and which made them a lot of money. If you want to understand the real world of trading, read this book.”

Bill Miller

Chairman and Chief Investment Officer, Legg Mason Capital Management

“Because Covel so clearly lays out these ingredients of success, his book is relevant not just to trend traders, but to anyone who aspires to greatness in the markets. The message is clear: to win, the odds must be in your favor, and you must have the fortitude to keep playing, remain consistent, and compound your edge. That’s a formula for success in any field of endeavor, which may be why the Turtle story finds universal appeal.”

Brett Steenbarger

“I did enjoy the book…I hope it’s doing well for you.”

Tom Shanks

Turtle

“The book was wonderful…”

Michael Shannon

Turtle

“Book is very good…thank you for going for the truth and objectivity.”

Lucy Wyatt

Turtle

“All in all, not bad. I wish it had never been done and I wish I were not in it, but I know that you were definitely going to do it, so I figured I would try to get the truth out as much as possible. By and large, it worked that way.”

Jim DiMaria

Turtle

“I can say that after hearing the turtle story many times from many of the people that are part of the story and after reading many articles about such story, this is by far the most entertaining, inspiring, extensive, and honest story of the turtles I have ever read.”

Francisco Vaca

Second Generation Turtle, Associate with Turtle Paul Rabar

The Complete TurtleTrader Editions and Translations

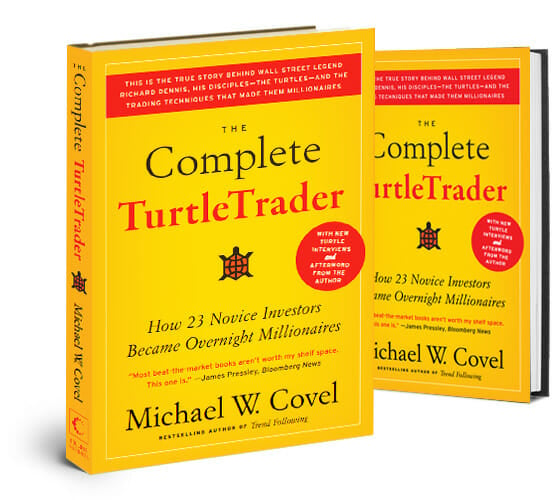

The Complete TurtleTrader (English)

The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires (Paperback)

Publisher: Collins Business

ISBN-10: 0061241717

ISBN-13: 9780061241710

High Resolution Cover Image

The Complete TurtleTrader (English)

The Complete TurtleTrader: The Legend, the Lessons, the Results (Hardcover)

Publisher: Collins Business

ISBN-10: 0061241709

ISBN-13: 9780061241703

High Resolution Cover Image

海龟交易特训班 (Chinese-Simplified)

出版社: 人民大學

商品條碼: 9787300109879

ISBN-13: 978-7-300-10987-9/F – 3730

High Resolution Cover Image

順勢投資-如何在市場起伏中致富 (Chinese-Traditional)

Publisher: 培生教育出版集團

ISBN-10: 9861542035

ISBN-13: 9789861542034

High Resolution Cover Image

Turtle-Trading: Die Strategie hinter dem größten Mythos der Tradinggeschichte (German)

Verlag: Börsenbuchverlag

ISBN-10: 3938350482

ISBN-13: 9783938350485

High Resolution Cover Image

Release

터틀 트레이딩 (Korean)

Publisher: 위즈덤하우스

ISBN-10: 8960861022

ISBN-13: 9788960861022

High Resolution Cover Image

ザ・タートル―投資家たちの士官学校 (Japanese)

Publisher: 日経BP社

商品コード: 4822246302

商品コード: 9784822246303

ЧЕРЕПАХИ-ТРЕЙДЕРЫ. ЛЕГЕНДАРНАЯ ИСТОРИЯ, ЕЕ УРОКИ И РЕЗУЛЬТАТЫ (Russian)

Издательство: Питер Пресс

Автор: Майкл Ковел

ISBN-13: 9785388003225

Teknős kereskedési szabályok (Hungarian)

Publio Kiadó

ISBN: 9789633816042

ISBN: 9789633816035

High Resolution Cover Image

The Complete TurtleTrader (Thai)

Publisher: Fidelity Publishing Co., Ltd.

ISBN: new book coming soon

Note: Some Turtles did not fare well.