“If there was a strategy that I would want to employ right now, if someone put a gun to my head, I’d say simple trend following strategies. They are not too popular today… They will probably do very well in the next 5 to 10 years.”

–Paul Tudor Jones, Market Wizard, May 3, 2022

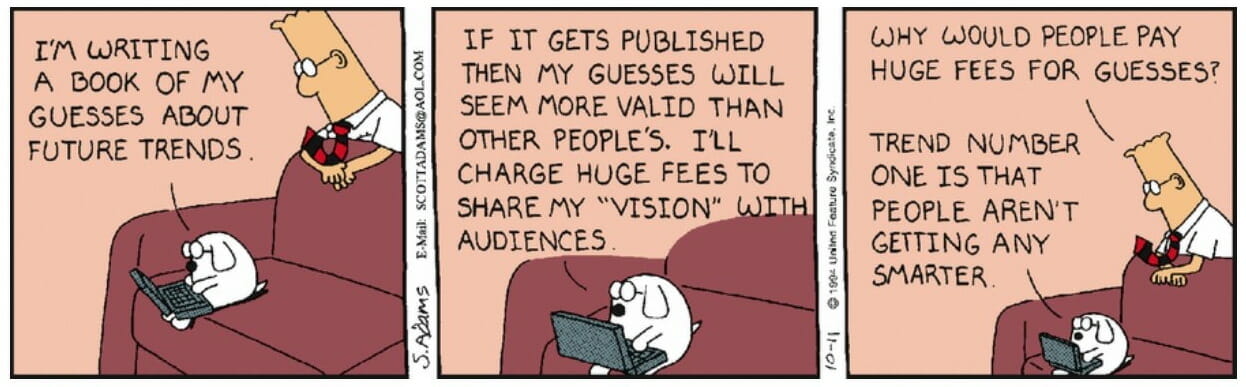

Trend following is counterintuitive. It goes against typical investment orthodoxy. It is not 5-minute bar trading, Warren Buffett, algo whatever, prediction, forecasting, buy and hold, fundamental analysis, value investing, day trading, HFT, Elliott Wave, candlestick patterns or traditional technical analysis charting bullshit.

Trend following is something different. Very different.

Consider a compilation of my favorite resources that serve as a first step guide to massive returns.

Michael Covel Trend Following Resources:

- Trend Following Preface (PDF)

- Michael Covel Interview (PDF)

- Podcast (Listen)

- Michael Covel (Kick Ass or Die)

- Trend Following Research Process

Third Party Trend Following Resources:

- A Century of Evidence on Trend Following Investing (PDF)

- Two Centuries of Trend Following (PDF).

- On the Origins and Nature of Trend Following (WEB)

- Speculation as a Fine Art: Dickson Watts (PDF)

- Memoirs of Extraordinary Popular Delusions by Charles MacKay Volume 1; 1841 (PDF)

- Memoirs of Extraordinary Popular Delusions by Charles MacKay Volume 1; 1852 (PDF)

- Reminiscences of a Stock Operator; 1923 (PDF)

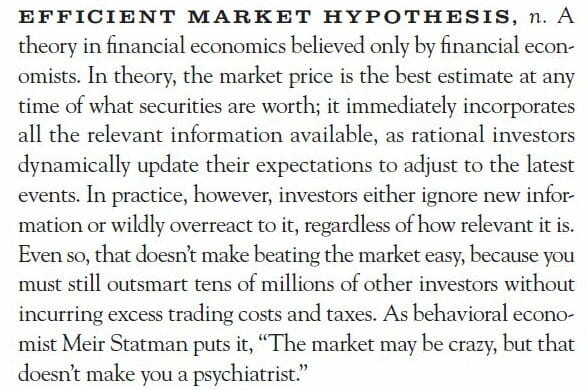

- Efficient Market Theory: When will it die? (PDF)

- Time series momentum (PDF)

- Trend following and the MCM system: An interview with Paul Mulvaney (PDF)

- Historical Performance of Trend Following (PDF)

- The Psychology and Neuroscience of Financial Decision Making (PDF)

- Economics Needs a Scientific Revolution (PDF)

- David Harding Interview I (PDF)

- David Harding Interview II (PDF)

- Financial Market History (PDF)

- The Loser’s Game (PDF)

- Fifty Years in Wall Street (PDF)

- Zero Sum Nature of Markets (PDF)

- PBS Special: Trillion Dollar Bet (VHS)

- Trend Following Risk & Return (PDF)

- David Hsieh & William Fung: Theory and Evidence (PDF)

- A Tail of Two Worlds: Fat Tails and Investing (PDF)

- Too Big to Fail: Long-Term Capital Management (PDF)

- Bet Sizing: Ed Seykota and David Druz (PDF)

- Gibbons Burke on Money Management (PDF)

- Frequency v. Magnitude (PDF)

- Kelly Original Paper March 21, 1956 (PDF)

- Decision-Making (PDF)

- Faith in the Markets (PDF)

- Mini-Contracts (PDF)

- Futures Basics (PDF)

- Trading Math Basics (PDF)

- Turtles in the Wall Street Journal (PDF)

- History of U.S. Bear & Bull Markets Since 1926 (PDF)

- Making Money From Mathematical Models (PDF)

- Run Profits, Cut Losses (PDF)

- Review of Michael Moore’s film on capitalism here.

Michael Covel Books and Film:

- Trend Following (BOOK)

- Trend Commandments (BOOK)

- The Complete TurtleTrader (BOOK)

- The Little Book of Trading (BOOK)

- Broke: The New American Dream (FILM)

- Michael Covel’s favorite books.

Larry Hite said it straight:

“I have noticed that everyone who ever told me that the markets are efficient is poor.”