Unknown to most trend following has endured for centuries. And sometimes investors not typically remembered as trend following traders–were exactly that.

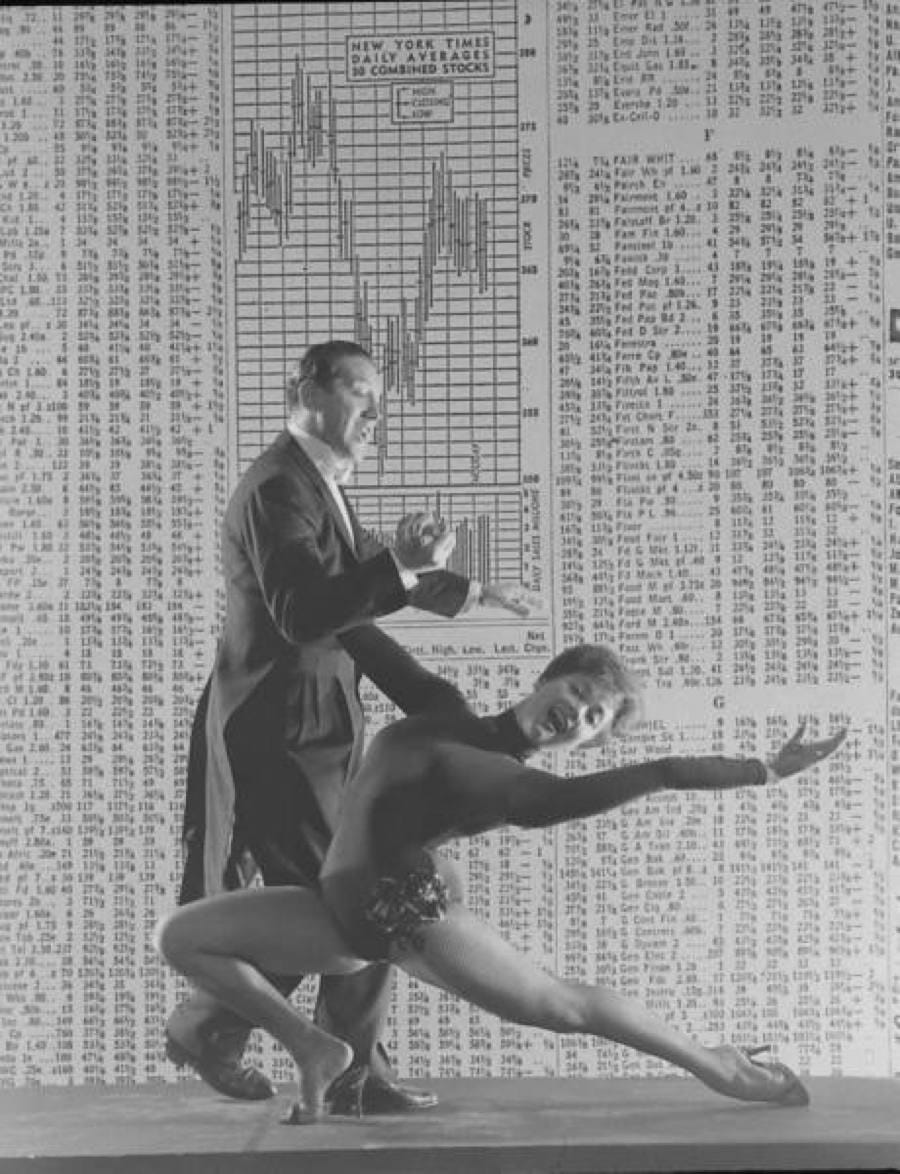

Pas de Dough with Nicolas Darvas

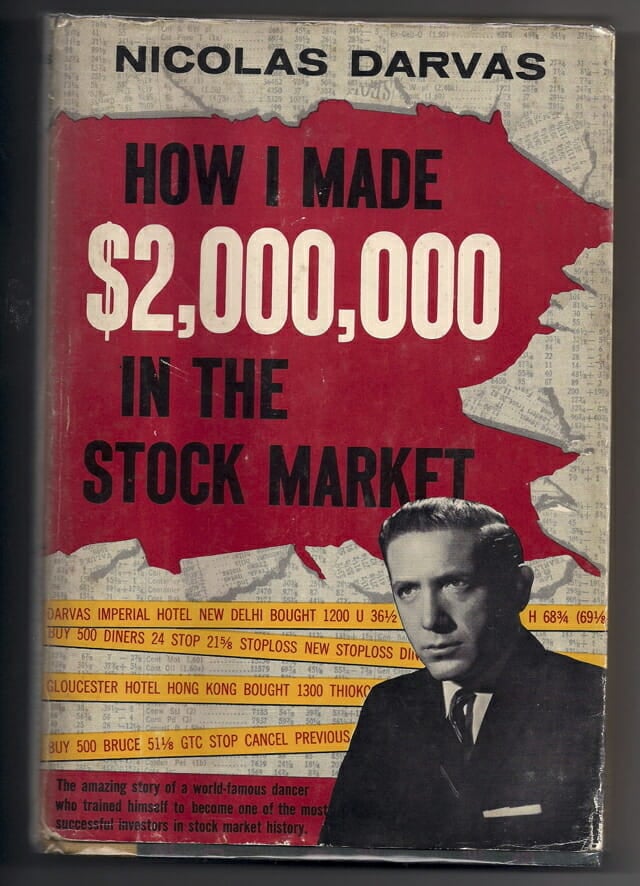

Nicolas Darvas (1920–1977) was a dancer, self-taught investor and author. He is best known for his book, “How I Made $2,000,000 in the Stock Market.”

Trend following trader? You bet.

From Time Magazine Monday, May. 25, 1959:

Monevman Darvas’ methods would raise the eyebrows of most Wall Streeters. Instead of studying what Wall Street calls the fundamentals—price-earning ratios and dividends—he judges public enthusiasm, a method that works best in volatile markets. “In my dancing I know how to judge an audience,” he says. “It is instinctive. The same way with the stock market. You have to find out what the public wants and go along with it. You can’t fight the tape, or the public.”

More:

Darvas’ system is tailored to his job. Since he has to do trading from wherever he is dancing (he recently completed an Asian tour) he ignores tips, financial stories and brokers’ letters, has never been in a broker’s office. Basically, his approach is that of a chartist: he watches price and volume.

More:

Suddenly, on 35,000 shares [random company] moved from 16 to 50. He bought in at 51, though he knew nothing about the company, and “I didn’t care what they made.” (They make hardwood flooring.) He sold out at 171 six weeks later.

More:

“I have no ego in the stock market,” he says. “If I make a mistake I admit it immediately and get out fast.” Darvas thinks his system is the height of conservatism. Says he: “If you could play roulette with the assurance that whenever you bet $100 you could get out for $98 if you lost your bet, wouldn’t you call that good odds?” If he has a big profit in a stock, he puts the stop-loss order just below the level at which a sliding stock should meet support. He bought Universal Controls at 18, sold it at 83 on the way down after it had hit 102. “I never bought a stock at the low or sold one at the high in my life,” says Darvas. “I am satisfied to be along for most of the ride.”

Question: Have the markets changed?

Darvas: “Have the markets changed” In short No. You see the markets are simply human emotion reflected in $$’s. People really need to get this into their heads. It’s not about logic. Company results. Mathematics but emotion. When emotion and logic collide. Emotion will always come out ahead. The way I traded in the 1950’s and made such fantastic money was simply the same method Livermore and Barauech traded before me. I traded the same way right the way through the 1960’s and 1970’s. And I am certain it will be the same going into the year 2000. It’s all about riding huge waves of emotion to the maximum. The big money is made from these moves. It’s crazy. But we are only human…Well you see, to me my method had to make sense. I had to be able to explain it to my partner (who knows absolutely noting about stocks) and she had to grasp the reason why it worked. In short it had to have a lot of common sense about it. My Darvas method was simply looking for the most in demand stocks, in the best sectors in a market Not GOING down. I would ride them as far as the ride would let me and exit when it was over…Makes sense right? But if you ask many traders to explain their method and straight away they mention Elliot Waves, Fib. Retracements, Cycles etc…my question is always So WHY should a stock go up because of this? I am always left with a blank expression. They simply had no valid reason to trade these stocks. It had no common sense reason to go up. And I found most complicated technical analysis is like this. Great on theory short in common sense. Traders are much better spending their time on managing them-selves and managing their money than trying to find a new “secret” to the markets.

Note: The two books which Nicolas Darvas read almost every week were The Battle for Investment Survival (PDF), by Gerald M. Loeb, published in 1935, and Tape Reading and Market Tactics (PDF), by Humphrey Bancroft Neill, published in 1931. The Battle for Investment Survival also in EPUB format.

How I Made $2,000,000 in the Stock Market

The classic trend following How I Made $2,000,000 in the Stock Market by Nicolas Darvas:

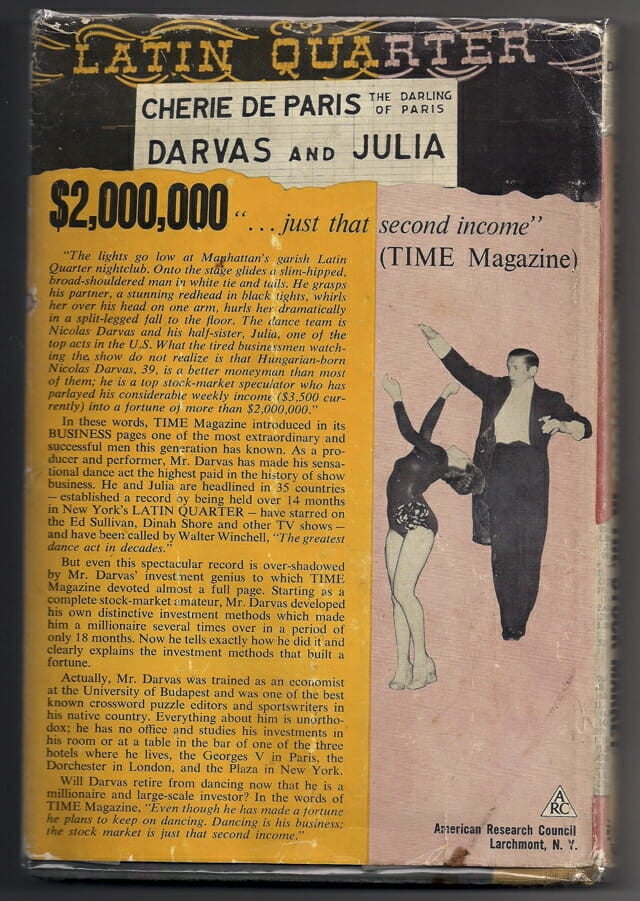

His other book Wall Street: The Other Las Vegas (front cover and back cover).

Profit in Lorillard

In late 1957, Darvas was performing in Saigon and noticed a volume spike in Lorillard. He began following the stock closely by asking his broker to begin providing daily quotes.

A. He identified Lorillard’s industry and learned that it was selling a lot of Kent and Old Gold cigarettes. While not a technology stock, cigarettes were a growth industry at this time, before the Surgeon General warning appeared on every pack. (For related reading, see The Stages Of Industry Growth.)

B. He bought 200 shares of Lorillard at 27½, as it broke above the box.

C. Unfortunately, his stop at 26 was hit a few days later when the stock price went back into the box.

D. Seeing continued strength reaffirmed his conviction that the stock was going higher, and Darvas repurchased 200 shares at 28¾.

E. Confident in his selection, Darvas bought another 400 shares at 35 and 36½.

F. Continued strength after the drop in February 1958 led to another purchase of 400 shares at 38.

G. To raise money to purchase another stock, Darvas closed his entire position at 57, for a profit of more than 60% in about six months. By comparison, the Dow Jones Industrial Average gained about 7.5% over that same time frame. (For more on evaluating returns, see Is Your Portfolio Beating Its Benchmark?); Source: “How I Made $2 Million In The Stock Market” (1960) by Nicolas Darvas

Investopedia notes: The simple Darvas used to profit from Lorillard can also work in the current markets. The internet has replaced the telegraph, and also provides real-time quotes, eliminating the need to wait for Barron’s to be delivered. Truth.

More on the origins of trend following.

Timeless. Enduring. Human nature never changes. Profit from it.