Feedback in:

Greetings Mr. Covel,

During one of your recent podcasts, you and Wesley Gray were discussing how the academic community considers the volatility of an asset’s price to be its risk while you and Gray consider the permanent loss of the capital invested in an asset to be its risk. Many years ago, I read an interview of Harry Markowitz where he stated that he used volatility to measure the risk of an asset because “it made the math easy.” I was completely shocked. The father of Modern Portfolio Theory chose his measure of risk based on its mathematical convenience.

I searched for the interview again because I wanted to send a link of it to you so that you could read it for yourself. Unfortunately, I could not find the interview but I still remember the feeling of complete shock that I felt when I read that Markowitz chose volatility as the measure of risk because “it made the math easy.”

What is your understanding of how volatility became the primary measure of risk in finance?

Regards,

[Name]

I don’t believe Markowitz believed that as you state, but rather was designing for theory. As you might recall he was surprised that modern finance was built off his work. He wrote the PhD paper, and others extrapolated his work into something else. Markowitz, himself, stated that “semi-variance is the more plausible measure of risk.”

But I have also see this:

“I would’ve created CAPM around semi-variance, but no one would have understood the math and I wouldn’t have won Nobel Prize…” –Harry Markowitz

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

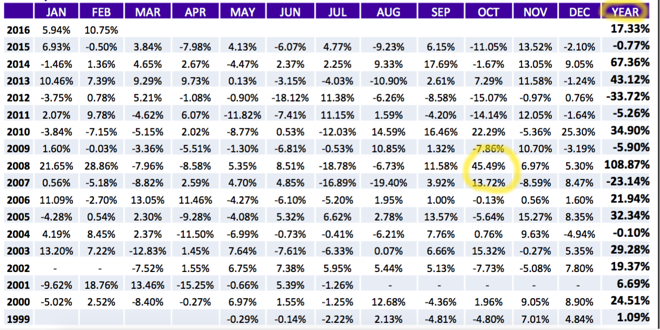

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.