It never dies.

People just want to believe.

Consider this excerpt:

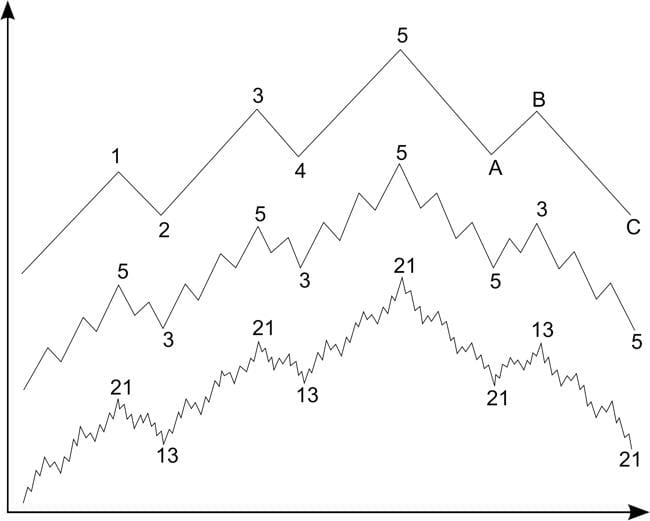

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. In Elliott’s model, market prices alternate between an impulsive, or motive phase, and a corrective phase on all time scales of trend, as the illustration shows. Impulses are always subdivided into a set of 5 lower-degree waves, alternating again between motive and corrective character, so that waves 1, 3, and 5 are impulses, and waves 2 and 4 are smaller retraces of waves 1 and 3. Corrective waves subdivide into 3 smaller-degree waves starting with a five-wave counter-trend impulse, a retrace, and another impulse. In a bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up. Motive waves always move with the trend, while corrective waves move against it. The patterns link to form five and three-wave structures which themselves underlie self-similar wave structures of increasing size or higher degree. Note the lowermost of the three idealized cycles. In the first small five-wave sequence, waves 1, 3 and 5 are motive, while waves 2 and 4 are corrective. This signals that the movement of the wave one degree higher is upward. It also signals the start of the first small three-wave corrective sequence. After the initial five waves up and three waves down, the sequence begins again and the self-similar fractal geometry begins to unfold according to the five and three-wave structure which it underlies one degree higher. The completed motive pattern includes 89 waves, followed by a completed corrective pattern of 55 waves. Each degree of a pattern in a financial market has a name. Practitioners use symbols for each wave to indicate both function and degree—numbers for motive waves, letters for corrective waves (shown in the highest of the three idealized series of wave structures or degrees). Degrees are relative; they are defined by form, not by absolute size or duration. Waves of the same degree may be of very different size and/or duration. The classification of a wave at any particular degree can vary, though practitioners generally agree on the standard order of degrees (approximate durations given):

-Grand supercycle: multi-century

-Supercycle: multi-decade (about 40–70 years)

-Cycle: one year to several years (or even several decades under an Elliott Extension)

-Primary: a few months to a couple of years

-Intermediate: weeks to months

-Minor: weeks

-Minute: days

-Minuette: hours

-Subminuette: minutes

Amazing.

Elliott Wave prose is almost as good as Scientology: Definitely No PhD Required.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.