Partial Media

- Masters in Business: Michael Covel

- Traders Magazine (PDF)

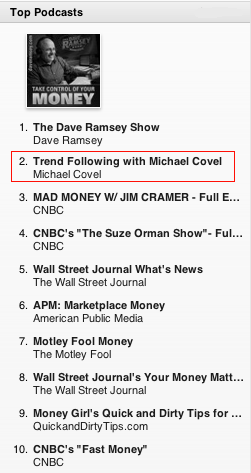

- #5 iTunes Investing Channel

- Nordic Business Media AB/Hedgefonder

- Pragmatic Capitalism

- Barrons

- DailyFinance/AOL

- Barrons

- The Wall Street Journal

- New York Post

- Globe and Mail (Canada)

- Orange County Business Journal

- Best Life Magazine

- Trader Magazine (German; English)

- Barrons

- The Straits Times (Singapore); 13 Weeks Bestseller Non-Fiction Top 10

The Complete TurtleTrader Book Reviews

- Trader Monthly

- Deraktionaer.de Interview (German)

- Bloomberg

- Brett Steenbarger

- Market Technicians Association

- SFO Magazine

Trend Following Book Reviews

- Market Technicians Association

- Blogcritics

- Barry Ritholtz

- Futures Japan Magazine

- Minneapolis Star Tribune

- Stocks, Futures and Options

- Yahoo! Finance

- Futures

- Legg Mason

- Rated Top Book Last 15 Years

- Stocks, Futures and Options

- Your Trading Edge (Australia)

Michael Covel Film Press

Magazine Covers

- Your Trading Edge

- Traders’ Magazine Cover (German; English)

- Futures Japan

- Technical Analysis of Stocks and Commodities

- The Traders Journal Magazine (Singapore)

Partial Radio & Television Appearances

- CCTV (China)

- Dennis Miller Radio Show

- Stansberry S&A Investor Radio with Porter Stansberry

- Stansberry S&A Investor Radio with Frank Curzio

- Fox Business TV with Eric Bolling

- Bloomberg

- Moe Ansari Market Wrap

- Jordan Kimmel Radio Show

- Tim Bourquin Radio Show

- Gabriel Wisdom Radio Show

- Jim Puplava Radio Show

- Chuck Jaffe Radio Show

- 25 City Radio Tour

- Sinclair Noe Radio Show

- Mike Norman Radio Show

- ROBTv.com TV

- Dick Fabian Radio Show

- Bob Brooks (Prudent Money)

- New York 1 News TV

- KFNN-AM Business For Breakfast

- Note: Dozens More Not Listed

Partial Published Articles

- Mises Institute (Michael Moore review)

- Daily Speculations (Michael Moore review)

- The Daily Reckoning (Michael Moore review)

- Stocks, Futures and Options Magazine

- The Daily Reckoning

- Trader Monthly

- Stocks, Futures and Options

- TheStreet.com

- Technical Analysis of Stocks and Commodities

- Futures Magazine

- Stocks, Futures and Options

- Superfund FUTURE

- Your Trading Edge (Australia)

- Stocks, Futures and Options

- Yahoo! Finance

- Market Technicians Association

- International Petroleum Finance

- Your Trading Edge (Australia)

- Yukan Fuji

Media contact.