A listener passed this along. An interesting post from Finance Trends (source):

Valeant Pharmaceuticals (VRX) is now big headline news, as the stock’s downward slide continues to punish investors, big and small.

Hedge fund manager, Bill Ackman of Pershing Square was reported to have lost $1 billion in a single day due to VRX’s latest plunge. Institutional ownership of Valeant’s stock was very widespread. As mentioned in our last post, a huge number of hedge funds and mutual funds owned big positions in VRX. Smaller investors may also be feeling the hit in their personal investment accounts or in their pension funds’ returns.

Let’s not focus too much on the investors who were unfortunate enough to get burned in this stock crash. The media and the investing world are already having a field day with this debacle. Instead, let’s take a fresh look at the chart to better understand why so many savvy investors were hurt in this decline.

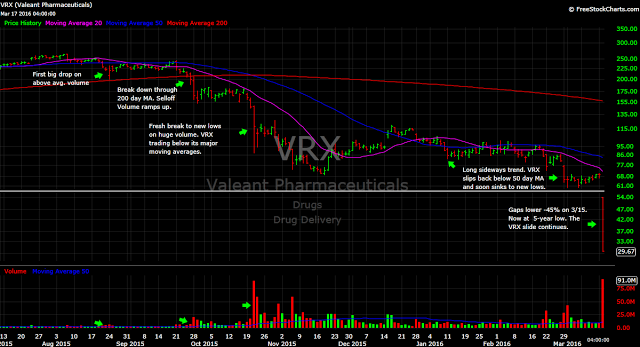

As you can see in this updated daily chart (see below), VRX had been showing signs of distribution (professional selling) for weeks heading into the fall of 2015.

After breaking down through its 200 day moving average (the red line), the stock moved sideways for a time before plunging through the $150 level. Here’s where the decline really accelerated and volume ramped up.

Towards the end of 2015, we saw a nice rebound in VRX and a bit of chatter about how “everything would be fine” and “here is a smart place for big investors to average down and buy more”, etc. Well, as recent events have shown us, that is not exactly how things played out for the investors who stubbornly held on to their bullish “thesis” for VRX.

At the start of this week, VRX was trading near $68. By Tuesday, the stock had plunged by over 50% to close at $33.49. As of today’s close, VRX is trading at $29.65, 60% lower from our previous Valeant (VRX) update at the end of February.

If you didn’t read my last post on VRX, go back and check out the closing section, “How to avoid disastrous stock declines”. If you know someone who is stubbornly holding on to major losses in their portfolio or trading account, share the article with them. While nothing is foolproof in investing, these simple ideas may help you pare or avoid the disastrous losses that can ruin any investor, big or small.

“The most important rule of trading is to play great defense, not great offense. Every day I assume every position I have is wrong. I know where my stop risk points are going to be. If they are going against me, then I have a game plan for getting out.” – Paul Tudor Jones, via Darvas Trader.

It all goes down the same.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.