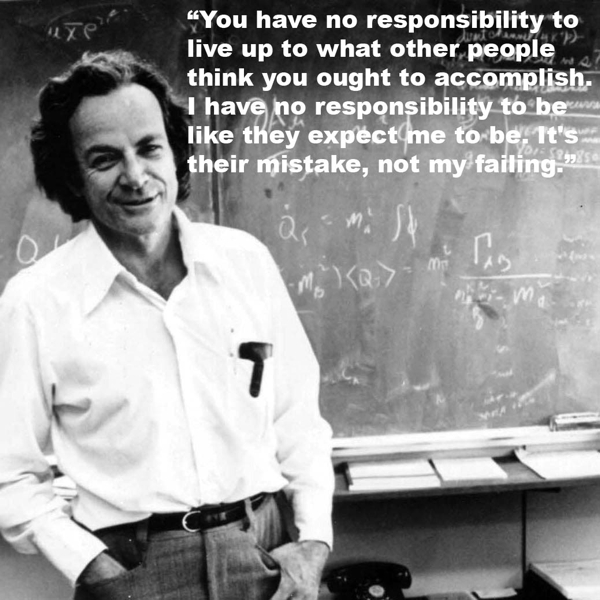

Trend followers trade the “price”. It’s the number that can’t be faked, the real indicator of the past, now and the future. Richard P. Feynman adds:

“You can know the name of a bird in all the languages of the world [think of all those so-called market fundamentals], but when you’re finished, you’ll know absolutely nothing whatever about the bird…So let’s look at the bird and see what it’s doing — that’s what counts.”

What is the market doing right now? That’s what counts. The price.

How can you move forward immediately to Trend Following profits? My books and my Flagship Course and Systems are trusted options by clients in 70+ countries.

Also jump in:

• Trend Following Podcast Guests

• Frequently Asked Questions

• Performance

• Research

• Markets to Trade

• Crisis Times

• Trading Technology

• About Us

Trend Following is for beginners, students and pros in all countries. This is not day trading 5-minute bars, prediction or analyzing fundamentals–it’s Trend Following.